Saks Fifth Avenue 2011 Annual Report Download - page 55

Download and view the complete annual report

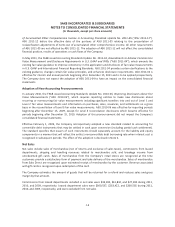

Please find page 55 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

Selling, General and Administrative Expenses (“SG&A”)

SG&A expenses consist primarily of employee compensation and benefit costs related to the selling and

administrative support functions; advertising; operating and maintenance costs; proprietary credit card

promotion, issuance and servicing costs; insurance programs; telecommunications; shipping and handling costs;

and other operating expenses not specifically categorized elsewhere on the Consolidated Statements of

Income. Payroll taxes, rent, depreciation, and property taxes are not included in SG&A.

Advertising and sales promotion costs are expensed in the period in which the advertising event takes place.

The Company receives allowances and expense reimbursements from merchandise vendors and from the

owner of the proprietary credit card portfolio which are netted against the related expense:

• Allowances received from merchandise vendors in conjunction with incentive compensation programs for

employees who sell the vendors’ merchandise and netted against the related compensation expense were

$35,657, $36,098, and $41,846 in 2011, 2010, and 2009, respectively.

• Allowances received from merchandise vendors in conjunction with jointly produced and distributed print

and television media and netted against the gross expenditures for such advertising were $30,526, $29,323,

and $33,287 in 2011, 2010, and 2009, respectively. Net advertising expenses were $59,036, $45,465, and

$36,025 in 2011, 2010, and 2009, respectively.

• Expense reimbursements received from the owner of the Company’s proprietary credit card portfolio are

discussed at Note 3 to these consolidated financial statements.

Store Pre-Opening Costs

Store pre-opening costs primarily consist of rent expense incurred during the construction of new stores,

payroll, and related media costs incurred in connection with new store openings. These costs are expensed as

incurred. Rent expense is generally incurred for six to twelve months prior to a store’s opening date.

Property and Equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed

using the straight-line method over the estimated useful lives of the assets. Buildings and building

improvements are depreciated over 20 to 40 years while fixtures and equipment are depreciated over 3 to 10

years. Leasehold improvements are amortized over the shorter of their estimated useful lives or their related

lease terms, generally ranging from 10 to 20 years. Lease terms may include renewal periods at the Company’s

option if exercise of the option is determined to be reasonably assured at the inception of the lease. Costs

incurred for the development of internal-use computer software are capitalized and amortized using the

straight-line method over 3 to 10 years. Costs incurred during the discovery and post-implementation stages of

internally-developed computer software are expensed as incurred.

Costs incurred when constructing stores, including interest expense, are capitalized. The Company may receive

allowances from landlords related to the construction. If the landlord is determined to be the primary

beneficiary of the property, then the portion of those allowances attributable to the property owned by the

landlord is considered to be a deferred rent liability, whereas the corresponding capital expenditures related to

that store are considered to be prepaid rent. Allowances in excess of the amounts attributable to the property

owned by the landlord are considered leasehold improvement allowances and are recorded as deferred rent

liabilities that are amortized over the life of the lease. Capital expenditures are reduced when the Company

receives cash and allowances from merchandise vendors to fund the construction of vendor shops.

F-10