Saks Fifth Avenue 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

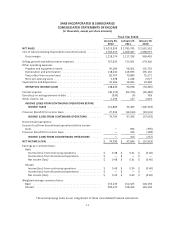

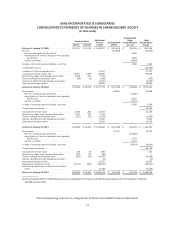

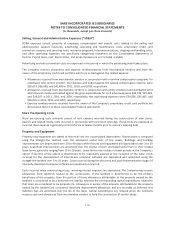

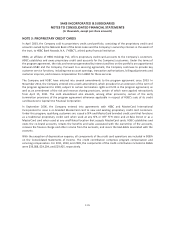

SAKS INCORPORATED & SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In thousands)

Additional

Paid-In

Capital

Accumulated

Deficit

Accumulated

Other

Comprehensive

Loss (1)

Total

Shareholders’

Equity

Common Stock

Shares Amount

Balance at January 31, 2009 .................. 142,170 $ 14,218 $ 1,148,227 $ (115,423) $ (56,436) $ 990,586

Net loss .................................. (57,919) (57,919)

Net gain arising during the period ............ 4,690

Amortization of net loss included in net periodic

benefit cost ........................... 7,828

Income tax effect ......................... (4,882)

Change in minimum pension liability, net of tax . . . 7,636 7,636

Comprehensive loss ......................... (50,283)

Issuance of 7.5% convertible notes ............. 21,147 21,147

Issuance of common stock, net ................ 15,097 1,509 94,689 96,198

Net activity under stock compensation plans ..... 2,608 261 (261) —

Shares withheld for employee taxes ............ (89) (9) (384) (393)

Income tax effect of stock compensation plans . . . (2,491) (2,491)

Stock-based compensation ................... 16,846 16,846

Balance at January 30, 2010 .................. 159,786 $ 15,979 $ 1,277,773 $ (173,342) $ (48,800) $ 1,071,610

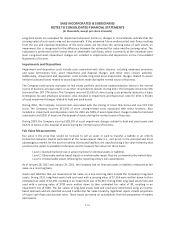

Net income ............................... 47,846 47,846

Net loss arising during the period ............ (1,840)

Amortization of net loss included in net periodic

benefit cost ........................... 6,281

Income tax effect ......................... (1,732)

Change in minimum pension liability, net of tax . . . 2,709 2,709

Comprehensive income ...................... 50,555

Issuance of common stock ................... 2,064 206 21,057 21,263

Net activity under stock compensation plans ..... 1,370 137 (137) —

Shares withheld for employee taxes ............ (321) (32) (2,564) (2,596)

Income tax effect of stock compensation plans . . . 5,967 5,967

Stock-based compensation ................... 16,766 16,766

Balance at January 29, 2011 .................. 162,899 $ 16,290 $ 1,318,862 $ (125,496) $ (46,091) $ 1,163,565

Net income ............................... 74,790 74,790

Net loss arising during the period ............ (16,602)

Amortization of net loss included in net periodic

benefit cost ........................... 2,254

Income tax effect ......................... 5,734

Change in minimum pension liability, net of tax . . . (8,614) (8,614)

Comprehensive income ...................... 66,176

Issuance of common stock ................... 183 18 498 516

Net activity under stock compensation plans ..... 891 89 (89) —

Shares withheld for employee taxes ............ (393) (39) (4,345) (4,384)

Income tax effect of stock compensation plans . . . (5) (5)

Stock-based compensation ................... 15,597 15,597

Repurchase of common stock ................. (3,537) (354) (28,578) (28,932)

Deferred tax adjustment related to convertible

notes .................................. (5,749) (5,749)

Balance at January 28, 2012 .................. 160,043 $ 16,004 $ 1,296,191 $ (50,706) $ (54,705) $ 1,206,784

(1) Accumulated Other Comprehensive Loss is composed of net gains and losses associated with the Company’s defined

benefit pension plan.

The accompanying notes are an integral part of these consolidated financial statements.

F-5