Saks Fifth Avenue 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

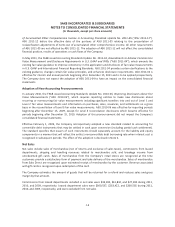

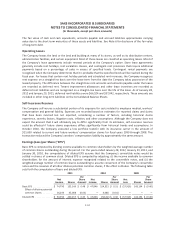

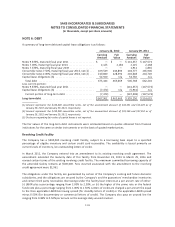

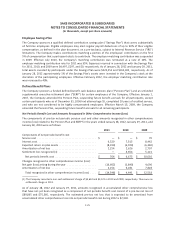

NOTE 4: PROPERTY AND EQUIPMENT

A summary of property and equipment is as follows:

January 28,

2012

January 29,

2011

Land and land improvements ...................................... $ 173,945 $ 174,283

Buildings ...................................................... 674,018 672,628

Leasehold improvements ......................................... 299,696 317,394

Fixtures and equipment .......................................... 812,820 810,251

Construction in progress .......................................... 43,001 15,906

2,003,480 1,990,462

Less: accumulated depreciation .................................... (1,128,049) (1,100,098)

Property and equipment, net ................................... $ 875,431 $ 890,364

Amounts above include gross assets recorded under capital leases for buildings and equipment of $98,595 and

$12,985, respectively as of January 28, 2012 and $98,595 and $7,056, respectively as of January 29, 2011.

Amortization of capital lease assets is included in depreciation expense. Accumulated depreciation of assets

recorded under capital leases was $93,327 and $89,686 as of January 28, 2012 and January 29, 2011,

respectively. During 2011 and 2010, capital lease asset additions were $5,929 and $2,800, which are considered

non-cash investing activities. There were no capital lease asset additions in 2009.

Depreciation expense was $118,513, $118,669, and $135,135 in 2011, 2010, and 2009, respectively.

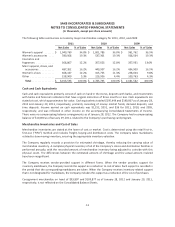

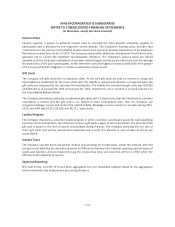

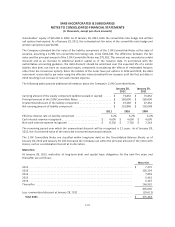

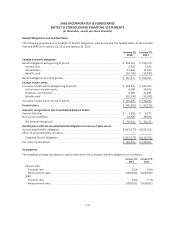

NOTE 5: INCOME TAXES

The components of income tax expense (benefit) from continuing operations are as follows:

2011 2010 2009

Current income taxes:

Federal .......................................... $ 540 $ (29,664) $ (4,261)

State ............................................ (2,707) (1,600) 345

Current income tax benefit ........................ (2,167) (31,264) (3,916)

Deferred income taxes:

Federal .......................................... 39,368 16,284 (34,266)

State ............................................ (10,107) 1,070 (6,319)

Deferred income tax expense (benefit) .............. 29,261 17,354 (40,585)

Income tax expense (benefit) from continuing operations . . $ 27,094 $ (13,910) $ (44,501)

F-16