Saks Fifth Avenue 2011 Annual Report Download - page 53

Download and view the complete annual report

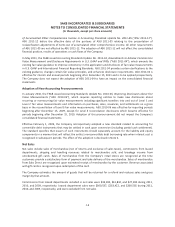

Please find page 53 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05 (“ASU 2011-12”).

ASU 2011-12 defers the effective date of the portions of ASU 2011-05 relating to the presentation of

reclassification adjustments of items out of accumulated other comprehensive income. All other requirements

of ASU 2011-05 are not affected by ASU 2011-12. The adoption of ASU 2011-12 will not affect the consolidated

financial position, results of operations or cash flows of the Company.

In May 2011, the FASB issued Accounting Standards Update No. 2011-04, Amendments to Achieve Common Fair

Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs (“ASU 2011-04”), which amends the

existing fair value guidance to improve consistency in the application and disclosure of fair value measurements

in U.S. GAAP and International Financial Reporting Standards. ASU 2011-04 provides certain clarifications to the

existing guidance, changes certain fair value principles, and enhances disclosure requirements. ASU 2011-04 is

effective for interim and annual periods beginning after December 15, 2011 and is to be applied prospectively.

The Company does not expect the adoption of ASU 2011-04 to have an impact on the consolidated financial

statements.

Adoption of New Accounting Pronouncements

In January 2010, the FASB issued Accounting Standards Update No. 2010-06, Improving Disclosures about Fair

Value Measurements (“ASU 2010-06”), which requires reporting entities to make new disclosures about

recurring or nonrecurring fair value measurements including significant transfers into and out of Level 1 and

Level 2 fair value measurements and information on purchases, sales, issuances, and settlements on a gross

basis in the reconciliation of Level 3 fair value measurements. ASU 2010-06 was effective for reporting periods

beginning after December 15, 2009, except for Level 3 reconciliation disclosures which became effective for

periods beginning after December 15, 2010. Adoption of this pronouncement did not impact the Company’s

consolidated financial statements.

Effective February 1, 2009, the Company retrospectively adopted a new standard related to accounting for

convertible debt instruments that may be settled in cash upon conversion (including partial cash settlement).

The standard specifies that issuers of such instruments should separately account for the liability and equity

components in a manner that will reflect the entity’s nonconvertible debt borrowing rate when interest cost is

recognized in subsequent periods. The effect of the adoption is disclosed in Note 6.

Net Sales

Net sales include sales of merchandise (net of returns and exclusive of sales taxes), commissions from leased

departments, shipping and handling revenues related to merchandise sold, and breakage income from

unredeemed gift cards. Sales of merchandise from the Company’s retail stores are recognized at the time

customers provide a satisfactory form of payment and take delivery of the merchandise. Sales of merchandise

from Saks Direct are recognized upon estimated receipt of merchandise by the customer. Revenue associated

with gift cards is recognized upon redemption of the card.

The Company estimates the amount of goods that will be returned for a refund and reduces sales and gross

margin by that amount.

Commissions from leased departments included in net sales were $43,184, $31,832, and $27,180 during 2011,

2010, and 2009, respectively. Leased department sales were $300,537, $233,422, and $200,535 during 2011,

2010, and 2009, respectively, and were excluded from net sales.

F-8