Saks Fifth Avenue 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

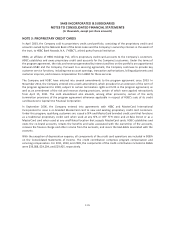

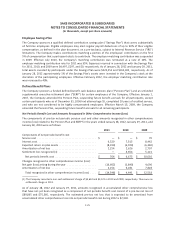

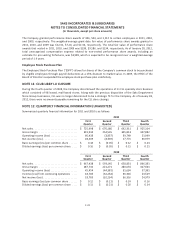

Employee Savings Plan

The Company sponsors a qualified defined contribution savings plan (“Savings Plan”) that covers substantially

all full-time employees. Eligible employees may elect regular payroll deductions of up to 90% of their eligible

compensation, as defined in the plan document, on a pre-tax basis, subject to Internal Revenue Service (“IRS”)

limitations. The Company makes contributions matching a portion of the employees’ contribution on the first

5% of compensation that a participant elects to contribute. The employer matching contribution was suspended

in 2009. Effective July 2010, the Company’s matching contribution was reinstated at a rate of 10%. The

employer matching contribution rate for 2011 was 35%. Expenses incurred in connection with the Savings Plan

for 2011, 2010, and 2009 were $4,497, $297, and $0, respectively. As of January 28, 2012 and January 29, 2011,

total assets invested by participants under the Savings Plan were $424,251 and $414,402, respectively. As of

January 28, 2012 approximately 1% of the Savings Plan’s assets were invested in the Company’s stock at the

discretion of the participating employees. Effective February 2012, the employer matching contribution rate

was increased to 40%.

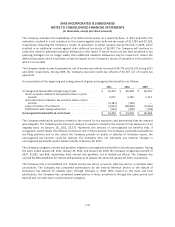

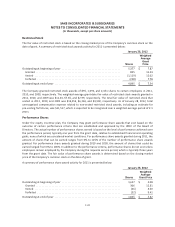

Defined Benefit Plans

The Company sponsors a funded defined-benefit cash balance pension plan (“Pension Plan”) and an unfunded

supplemental executive retirement plan (“SERP”) for certain employees of the Company. Effective January 1,

2007, the Company amended the Pension Plan, suspending future benefit accruals for all participants, except

certain participants who as of December 31, 2006 had attained age 55, completed 10 years of credited service,

and who are not considered to be highly compensated employees. Effective March 13, 2009, the Company

amended the Pension Plan, suspending future benefit accruals for all remaining participants.

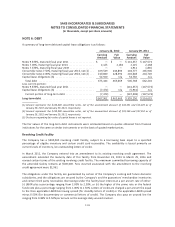

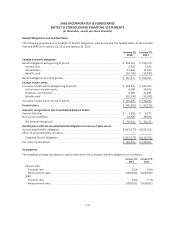

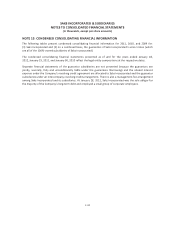

Net Periodic Benefit Cost and Amounts Recognized in Other Comprehensive Income (Loss)

The components of pre-tax net periodic pension cost and other amounts recognized in other comprehensive

income (loss) related to the Pension Plan and SERP for the years ended January 28, 2012, January 29, 2011, and

January 30, 2010 were as follows:

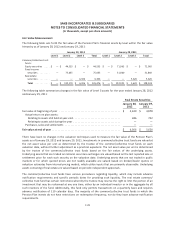

2011 2010 2009

Components of net periodic benefit cost:

Service cost ......................................... $ — $ — $ 70

Interest cost ......................................... 6,520 7,315 8,442

Expected return on plan assets .......................... (8,010) (6,920) (6,330)

Amortization of net loss ............................... 2,254 2,626 2,707

Settlement loss recognized (1) .......................... — 3,654 5,121

Net periodic benefit cost ............................. $ 764 $ 6,675 $ 10,010

Changes recognized in other comprehensive income (loss):

Net gain (loss) arising during the year .................... (16,602) (1,840) 4,690

Amortization of net loss ............................... 2,254 6,281 7,828

Total recognized in other comprehensive income (loss) .... $ (14,348) $ 4,441 $ 12,518

(1) The Company recorded a non-cash settlement charge of $3,654 and $5,121 in 2010 and 2009, respectively. There was no

settlement charge in 2011.

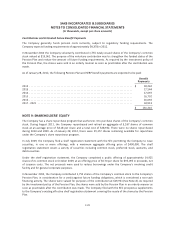

As of January 28, 2012 and January 29, 2011, amounts recognized in accumulated other comprehensive loss

that have not yet been recognized as a component of net periodic benefit cost consist of a pre-tax net loss of

$89,865 and $75,560, respectively. The estimated pre-tax net loss that is expected to be amortized from

accumulated other comprehensive loss into net periodic benefit cost during 2012 is $2,904.

F-25