Saks Fifth Avenue 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

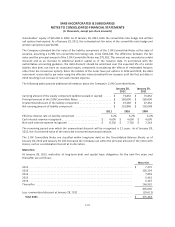

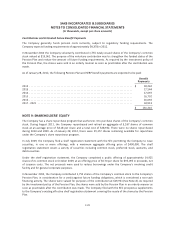

The Company made interest payments of $31,681, $35,286, and $36,388, of which $955, $721, and $758 was

capitalized into property and equipment during 2011, 2010, and 2009, respectively.

NOTE 7: COMMITMENTS AND CONTINGENCIES

Operating Leases and Other Purchase Commitments

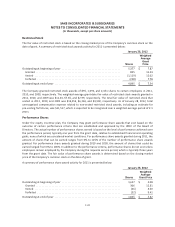

The Company leases certain property and equipment under various non-cancelable capital and operating

leases. The leases provide for monthly fixed amount rentals or contingent rentals based upon sales in excess of

stated amounts and normally require the Company to pay real estate taxes, insurance, common area

maintenance costs and other occupancy costs. Generally, the leases have primary terms ranging from 20 to 30

years and include renewal options ranging from 5 to 20 years.

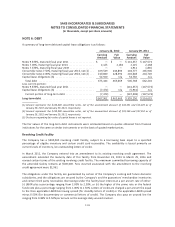

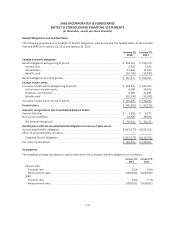

At January 28, 2012, future minimum rental commitments under capital leases and non-cancelable operating

leases consisted of the following:

Capital Leases

Operating

Leases

2012 .......................................................... $ 13,229 $ 57,930

2013 .......................................................... 13,132 53,084

2014 .......................................................... 12,251 45,782

2015 .......................................................... 10,070 42,256

2016 .......................................................... 9,403 38,857

Thereafter ...................................................... 24,013 121,598

Total minimum lease payments .................................. $ 82,098 $ 359,507

Less: portion representing interest .................................. (29,178)

Total capital lease obligations .................................... $ 52,920

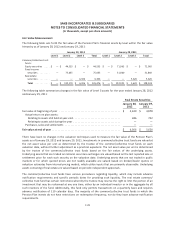

Total rental expense for operating leases was $99,184, $98,501, and $101,756, during 2011, 2010, and 2009,

respectively, including contingent rent of $16,054, $14,284, and $13,301, respectively, and common area

maintenance costs of $11,919, $11,611, and $12,299, respectively.

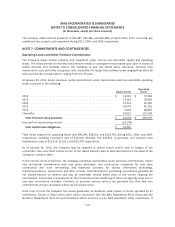

As of January 28, 2012, the Company may be required to deliver shares and/or cash to holders of the

convertible notes described in Note 6 prior to the stated maturity date of said notes based on the value of the

Company’s common stock.

In the normal course of business, the Company purchases merchandise under purchase commitments; enters

into contractual commitments with real estate developers and construction companies for new store

construction and store remodeling; and maintains contracts for various information technology,

telecommunications, maintenance and other services. Commitments for purchasing merchandise generally do

not extend beyond six months and may be cancelable several weeks prior to the vendor shipping the

merchandise. Contractual commitments for the construction and remodeling of stores are typically lump sum or

cost plus construction contracts. Contracts to purchase various services are generally less than two year

commitments and are cancelable within several weeks notice.

From time to time the Company has issued guarantees to landlords under leases of stores operated by its

subsidiaries. Certain of these stores were sold in connection with the Saks Department Store Group and the

Northern Department Store Group transactions which occurred in July 2005 and March 2006, respectively. If

F-23