Saks Fifth Avenue 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

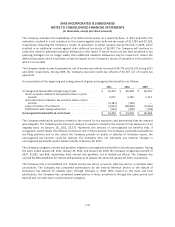

NOTE 3: PROPRIETARY CREDIT CARDS

In April 2003, the Company sold its proprietary credit card portfolio, consisting of the proprietary credit card

accounts owned by the National Bank of the Great Lakes and the Company’s ownership interest in the assets of

the trust, to HSBC Bank Nevada, N.A. (“HSBC”), a third party financial institution.

HSBC, an affiliate of HSBC Holdings PLC, offers proprietary credit card accounts to the Company’s customers.

HSBC establishes and owns proprietary credit card accounts for the Company’s customers. Under the terms of

the program agreement, the risks and revenues generated by interest and fees on the portfolio are apportioned

between HSBC and the Company. Pursuant to a servicing agreement, the Company continues to provide key

customer service functions, including new account openings, transaction authorizations, billing adjustments and

customer inquiries, and receives compensation from HSBC for these services.

The Company and HSBC have entered into several amendments to the program agreement since 2003. In

November 2011, the Company entered into a sixth amendment, which provides for an extension of the term of

the program agreement to 2018, subject to certain termination rights set forth in the program agreement, as

well as an amendment of the risk and revenue sharing provisions, certain of which were applied retroactively

from April 15, 2011. The sixth amendment also amends, among other provisions, certain of the early

termination provisions of the program agreement otherwise applicable in respect of HSBC’s sale of its credit

card business to Capital One Financial Corporation.

In September 2006, the Company entered into agreements with HSBC and MasterCard International

Incorporated to issue a co-branded MasterCard card to new and existing proprietary credit card customers.

Under this program, qualifying customers are issued a SFA and MasterCard branded credit card that functions

as a traditional proprietary credit card when used at any SFA or OFF 5TH store and at Saks Direct or as a

MasterCard card when used at any unaffiliated location that accepts MasterCard cards. HSBC establishes and

owns the co-brand accounts, retains the benefits and sales associated with the ownership of the accounts,

receives the finance charge and other income from the accounts, and incurs the bad-debts associated with the

accounts.

With the exception of depreciation expense, all components of the credit card operations are included in SG&A

on the Consolidated Statements of Income. The credit contribution comprises program compensation and

servicing compensation. For 2011, 2010, and 2009, the components of the credit contribution included in SG&A

were $33,088, $24,204, and $29,425, respectively.

F-15