Saks Fifth Avenue 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

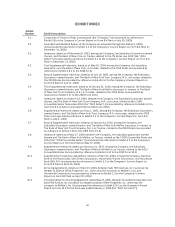

EXHIBIT INDEX

Exhibit

Number Exhibit Description

3.1 Composite of Charter of Saks Incorporated (the “Company”) (incorporated by reference to

Exhibit 3(i) to the Company’s Current Report on Form 8-K filed on July 30, 2009).

3.2 Amended and Restated Bylaws of the Company (as amended through December 9, 2009)

(incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on

December 14, 2009).

4.1 Indenture, dated as of December 8, 2003, among the Company, the Subsidiary Guarantors named

therein, and the Bank of New York, as Trustee, related to the 7% Notes due 2013 (the “2013

Notes”) (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K

filed on December 11, 2003)

4.2 First Supplemental Indenture, dated as of May 20, 2004, among the Company, the Subsidiary

Guarantors and the Bank of New York, as Trustee, related to the 2013 Notes (incorporated by

reference to Exhibit 4.8.1 to the 2008 10-K)

4.3 Second Supplemental Indenture, dated as of July 19, 2005, among the Company, the Subsidiary

Guarantors named therein, and The Bank of New York Trust Company, N.A., as trustee, related to

the 2013 Notes (incorporated by reference to Exhibit 4.2 to the Company’s Current Report on

Form 8-K filed on July 21, 2005)

4.4 Third Supplemental Indenture, dated as of January 31, 2010, among the Company, the Subsidiary

Guarantors named therein, and The Bank of New York Mellon (successor in interest to The Bank

of New York Trust Company, N.A.), as Trustee, related to the 2013 Notes (incorporated by

reference to Exhibit 4.27 to the 2009 Form 10-K)

4.5 Indenture, dated as of March 23, 2004, between the Company, the Subsidiary Guarantors named

therein, and The Bank of New York Trust Company, N.A., as trustee, related to the 2.00%

Convertible Senior Notes due 2024 (the “2024 Notes”) (incorporated by reference to Exhibit 4.1 to

the Form 8-K of Saks Incorporated filed on March 26, 2004)

4.6 Supplemental Indenture, dated as of July 1, 2005, among the Company, the Subsidiary Guarantors

named therein, and The Bank of New York Trust Company, N.A., as trustee, related to the 2024

Notes (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K

filed on July 6, 2005)

4.7 Second Supplemental Indenture, dated as of January 31, 2010, among the Company, the

Subsidiary Guarantors named therein, and The Bank of New York Mellon (successor in interest to

The Bank of New York Trust Company, N.A.), as Trustee, related to the 2024 Notes (incorporated

by reference to Exhibit 4.30 to the 2009 Form 10-K)

4.8 Indenture, dated as of May 27, 2009, between the Company, the subsidiary guarantors named

therein and The Bank of New York Mellon, as Trustee, related to the 7.50% Convertible Notes due

2013 (the “2013 Convertible Notes”) (incorporated by reference to Exhibit 4.1 to the Company’s

Current Report on Form 8-K filed on May 27, 2009)

4.9 Supplemental Indenture, dated as of January 31, 2010, among the Company, the Subsidiary

Guarantors named therein, and The Bank of New York Mellon, as Trustee, related to the 2013

Convertible Notes (incorporated by reference to Exhibit 4.32 to the 2009 Form 10-K)

10.1 Supplemental Transaction Agreement, dated as of April 15, 2003, among the Company, National

Bank of the Great Lakes, Saks Credit Corporation, Household Finance Corporation, and Household

Bank (SB), N.A. (incorporated by reference to Exhibit 2.2 to the Company’s Current Report on

Form 8-K filed on April 29, 2003)

10.2 Servicing Agreement, dated as of April 15, 2003, between Saks Fifth Avenue, Inc. (successor by

merger to Jackson Office Properties, Inc., which was the successor to McRae’s, Inc.) and

Household Corporation (incorporated by reference to Exhibit 2.3 to the Company’s Current

Report on Form 8-K filed on April 29, 2003)

10.3 First Amendment to Servicing Agreement, dated May 27, 2005, between Household Corporation and

Saks Fifth Avenue, Inc. (successor by merger to Jackson Office Properties, Inc., which was the

successor to McRae’s, Inc.) (incorporated by reference to Exhibit 10.6.1 to the Company’s Annual

Report on Form 10-K for the fiscal year ended February 2, 2008 (the “2007 Form 10-K”))

40