Saks Fifth Avenue 2011 Annual Report Download - page 52

Download and view the complete annual report

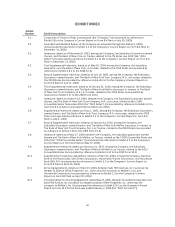

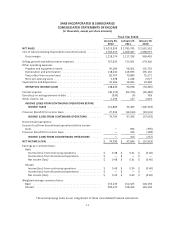

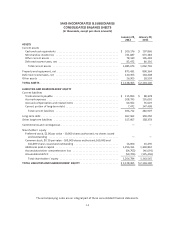

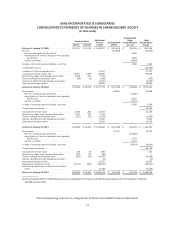

Please find page 52 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

NOTE 1: NATURE OF OPERATIONS

Saks Incorporated, a Tennessee corporation first incorporated in 1919, and its subsidiaries (together the

“Company”) consist of Saks Fifth Avenue (“SFA”) stores and SFA e-commerce operations (“Saks Direct”) as well

as Saks Fifth Avenue OFF 5TH (“OFF 5TH”). Previously, the Company also operated Club Libby Lu (“CLL”) (the

operations of which were discontinued in January 2009).

As of January 31, 2009, the Company discontinued the operations of its CLL business, which consisted of 98

leased, mall-based specialty stores, targeting girls aged 4-12 years old. Discontinued operations include nominal

charges (income) for 2009 and 2010 from residual CLL store closing activities.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries.

All intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”)

requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from these

estimates.

Fiscal Year

The Company’s fiscal year ends on the Saturday closest to January 31st. Fiscal years 2011, 2010, and 2009

ended on January 28, 2012 (“2011”), January 29, 2011 (“2010”), and January 30, 2010 (“2009”), respectively.

Recently Issued Accounting Pronouncements

In December 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2011-11, Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”). ASU 2011-11 enhances

disclosure requirements regarding financial instruments and derivative instruments that are either offset or

subject to an enforceable master netting arrangement or similar agreement. ASU 2011-11 requires disclosure of

both net and gross information for these assets and liabilities in order to enhance comparability between those

entities that prepare their financial statements in accordance with U.S. GAAP and those entities that prepare

their financial statements in accordance with International Financial Reporting Standards. ASU 2011-11 is

effective for annual reporting periods beginning on or after January 1, 2013 and interim periods within those

annual periods. The adoption of ASU 2011-11 will not affect the consolidated financial position, results of

operations or cash flows of the Company.

In June 2011, the FASB issued Accounting Standards Update No. 2011-05, Presentation of Comprehensive

Income (“ASU 2011-05”). ASU 2011-05 requires reporting entities to present the total of comprehensive

income, the components of net income, and the components of other comprehensive income either in a single

continuous statement of comprehensive income or in two separate but consecutive statements. ASU 2011-05 is

effective for fiscal years, and interim periods within those years, beginning after December 15, 2011 and is to be

applied retrospectively. The adoption of ASU 2011-05 will not affect the consolidated financial position, results

of operations, or cash flows of the Company. In December 2011, the FASB issued Accounting Standards Update

No. 2011-12, Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out

F-7