Saks Fifth Avenue 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

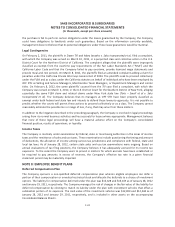

the purchasers fail to perform certain obligations under the leases guaranteed by the Company, the Company

could have obligations to landlords under such guarantees. Based on the information currently available,

management does not believe that its potential obligations under these lease guarantees would be material.

Legal Contingencies

On February 2, 2011, the plaintiffs in Dawn Till and Mary Josephs v. Saks Incorporated et al, filed a complaint,

with which the Company was served on March 10, 2011, in a purported class and collective action in the U.S.

District Court for the Northern District of California. The complaint alleges that the plaintiffs were improperly

classified as exempt from the overtime pay requirements of the Fair Labor Standards Act (“FLSA”) and the

California Labor Code and that the Company failed to pay overtime, provide itemized wage statements and

provide meal and rest periods. On March 8, 2011, the plaintiffs filed an amended complaint adding a claim for

penalties under the California Private Attorneys General Act of 2004. The plaintiffs seek to proceed collectively

under the FLSA and as a class under the California statutes on behalf of individuals who have been employed by

OFF 5TH as Selling and Service Managers, Merchandise Team Managers, or Department Managers and similar

titles. On February 8, 2012, the same plaintiffs’ counsel from the Till case filed a complaint, with which the

Company was served on March 2, 2012, in the U.S. District Court for the Southern District of New York, alleging

essentially the same FLSA claim and related claims under New York state law (Tate – Small et al v. Saks

Incorporated et al). The Company believes that its managers at OFF 5TH have been properly classified as

exempt under both federal and state law and intends to defend these lawsuits vigorously. It is not possible to

predict whether the courts will permit these actions to proceed collectively or as a class. The Company cannot

reasonably estimate the possible loss or range of loss, if any, that may arise from these matters.

In addition to the litigation described in the preceding paragraph, the Company is involved in legal proceedings

arising from its normal business activities and has accruals for losses where appropriate. Management believes

that none of these legal proceedings will have a material adverse effect on the Company’s consolidated

financial position, results of operations, or liquidity.

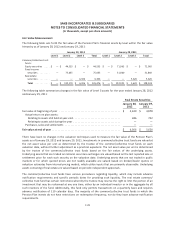

Income Taxes

The Company is routinely under examination by federal, state or local taxing authorities in the areas of income

taxes and the remittance of sales and use taxes. These examinations include questioning the timing and amount

of deductions, the allocation of income among various tax jurisdictions and compliance with federal, state and

local tax laws. As of January 28, 2012, certain state sales and use tax examinations were ongoing. Based on

annual evaluations of tax filing positions, the Company believes it has adequately accrued for its income tax

exposures. To the extent the Company were to prevail in matters for which accruals have been established or

be required to pay amounts in excess of reserves, the Company’s effective tax rate in a given financial

statement period may be materially impacted.

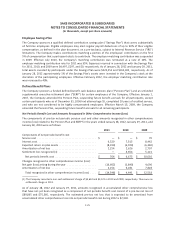

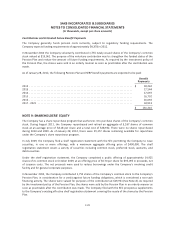

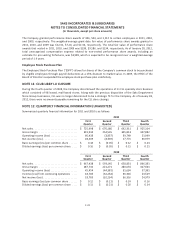

NOTE 8: EMPLOYEE BENEFIT PLANS

Deferred Compensation Plan

The Company sponsors a non-qualified deferred compensation plan wherein eligible employees can defer a

portion of their compensation or unvested restricted stock and allocate the deferrals to a choice of investment

options. The liability for compensation deferred under this plan was $12,428 and $13,169 as of January 28, 2012

and January 29, 2011, respectively. The Company manages the risk of changes in the fair value of the liability for

deferred compensation by electing to match its liability under the plan with investment vehicles that offset a

substantial portion of its exposure. The cash value of the investment vehicles was $12,000 and $12,568 as of

January 28, 2012 and January 29, 2011, respectively, and is included in other assets on the accompanying

Consolidated Balance Sheets.

F-24