Saks Fifth Avenue 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities.

Market Information

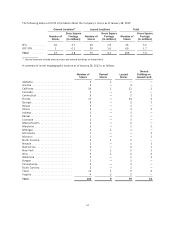

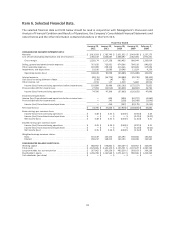

The Company’s common stock is traded on the New York Stock Exchange under the symbol “SKS”. The table

below sets forth the high and low sales prices of the Company’s common stock as reported on the New York

Stock Exchange during each quarter of 2011 and 2010.

2011 2010

High Low High Low

First Quarter .................................. $ 12.97 $ 10.90 $ 10.65 $ 6.14

Second Quarter ............................... $ 12.07 $ 10.02 $ 10.37 $ 7.06

Third Quarter ................................. $ 11.50 $ 7.67 $ 11.49 $ 6.60

Fourth Quarter ................................ $ 11.24 $ 8.49 $ 12.22 $ 10.52

Holders

As of March 9, 2012, there were approximately 2,260 shareholders of record of the Company’s common stock.

Dividends

During 2011 and 2010, the Company did not declare any dividends. Future dividends, if any, will be determined

by the Company’s Board of Directors in light of circumstances then existing, including earnings, financial

requirements, and general business conditions. The Company does not anticipate declaring dividends in the

near term.

Securities Authorized for Issuance under Equity Compensation Plans

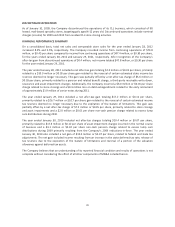

The following table provides equity compensation plan information for all plans approved and not approved by

the Company’s shareholders, as of January 28, 2012:

(In thousands, except

per share amounts) Number of securities

to be issued upon

exercise of outstanding

options, warrants and

rights (#)

(a)

Weighted-average

exercise price of

outstanding options,

warrants and

rights ($)

(b)

Number of securities

remaining available

for future issuance under

equity compensation

plans (excluding securities

in column (a)) (1)

(c)Plan Category

Equity compensation plans

approved by security holders . . . 1,605 $ 13.00 2,675

Equity compensation plans not

approved by security

holders (2) .................. 41$ 6.28 -

Total ....................... 1,646 $ 12.83 2,675

(1) This amount represents shares of common stock available for issuance under the 2009 Long-term Incentive Plan. Awards

available for grant under the 2009 Long-term Incentive Plan include stock options, stock appreciation rights, restricted

stock, performance shares, and other forms of equity awards.

(2) On April 9, 1997, the Board approved the Company’s 1997 Stock-Based Incentive Plan (the “1997 Plan”) to assist in

attracting, retaining, and motivating employees and directors. The Board amended the 1997 Plan several times. The

exercise price for all outstanding options awarded under the 1997 Plan equals the fair market value of the common stock

on the date of grant. Most options vest in four installments over four years and expire after ten years. Unvested options

16