Saks Fifth Avenue 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

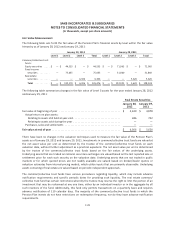

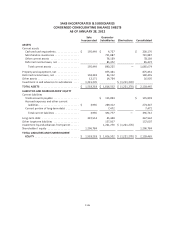

Fair Value Measurements

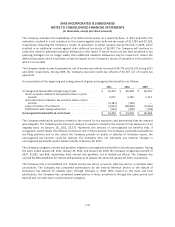

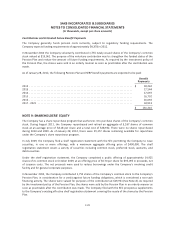

The following table sets forth the fair value of the Pension Plan’s financial assets by level within the fair value

hierarchy as of January 28, 2012 and January 29, 2011:

January 28, 2012 January 29, 2011

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Common/collective trust

funds:

Equity securities ..... $ — $ 44,535 $ — $ 44,535 $ — $ 71,065 $ — $ 71,065

Fixed income

securities ......... — 75,635 — 75,635 — 51,860 — 51,860

Real estate

securities ......... — — 6,306 6,306 — — 5,620 5,620

Total ............ $ — $ 120,170 $ 6,306 $ 126,476 $ — $ 122,925 $ 5,620 $ 128,545

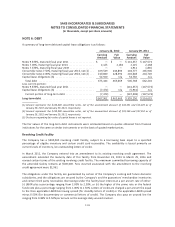

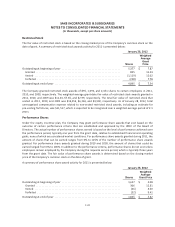

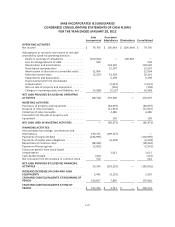

The following table summarizes changes in the fair value of Level 3 assets for the year ended January 28, 2012

and January 29, 2011:

Real Estate Securities

January 28,

2012

January 29,

2011

Fair value at beginning of year ........................................... $ 5,620 $ 4,878

Actual return on plan assets:

Relating to assets still held at year-end ................................. 686 742

Relating to assets sold during the year ................................. — —

Purchases, sales and settlements ....................................... — —

Fair value at end of year ................................................ $ 6,306 $ 5,620

There have been no changes in the valuation techniques used to measure the fair value of the Pension Plan’s

assets as of January 28, 2012 and January 29, 2011. Investments in common/collective trust funds are valued at

the net asset value per unit as determined by the trustee of the common/collective trust funds on each

valuation date, without further adjustment as a practical expedient. The net asset value per unit is determined

by the trustee of the common/collective trust funds based on the fair values of the underlying assets.

Underlying assets that are traded on national securities exchanges are valued based on the last reported sale or

settlement price for each such security on the valuation date. Underlying assets that are not traded in public

markets or for which quoted prices are not readily available are valued based on broker/dealer quotes or

valuation estimates from internal pricing models, which utilize inputs that are primarily observable. Underlying

assets consisting of real estate are valued based on periodic independent appraisals.

The common/collective trust funds have various procedures regarding liquidity, which may include advance

notification requirements and specific periodic dates for providing such liquidity. The real estate common/

collective trust fund has certain restrictions whereby the trustee may reserve the right to limit the portion of an

investment that may be redeemed at any one time, either by an individual investor or in the aggregate by all

such investors of the fund. Additionally, this fund only permits transactions on a quarterly basis and requires

advance notification of 110 calendar days. The majority of the common/collective trust funds in which the

Pension Plan invests do not have restrictions on redemption frequency, nor do they have advance notification

requirements.

F-28