Saks Fifth Avenue 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

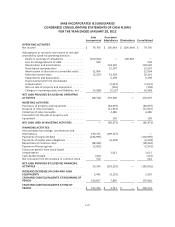

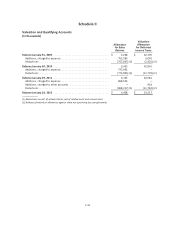

Schedule II

Valuation and Qualifying Accounts

(In thousands)

Allowance

for Sales

Returns

Valuation

Allowance

for Deferred

Income Taxes

Balance January 31, 2009 ....................................... $ 4,238 $ 42,190

Additions, charged to expense ................................. 765,534 3,045

Deductions ................................................. (765,867) (1) (2,425) (2)

Balance January 30, 2010 ....................................... 3,905 42,810

Additions, charged to expense ................................. 775,092 —

Deductions ................................................. (774,895) (1) (12,729) (2)

Balance January 29, 2011 ....................................... 4,102 30,081

Additions, charged to expense ................................. 868,523 —

Additions, charged to other accounts ............................ — 918

Deductions ................................................. (868,217) (1) (11,782) (2)

Balance January 28, 2012 ....................................... $ 4,408 $ 19,217

(1) Deductions consist of actual returns, net of related costs and commissions.

(2) Release of valuation allowance against state net operating loss carryforwards.

F-43