Saks Fifth Avenue 2011 Annual Report Download - page 27

Download and view the complete annual report

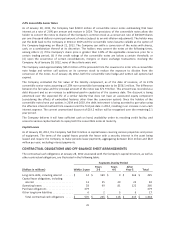

Please find page 27 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOL carryforwards, the effect of concluding tax examinations and other tax reserve adjustments primarily

relating to statute expirations, and the change in the overall state tax rate. Including the effect of these items,

the Company’s effective income tax rate for continuing operations was (41.5%) and 43.6% in 2010 and 2009,

respectively. The effective tax benefit rate for 2010 was primarily due to the reversal of an uncertain tax

position relating to statute expirations.

LIQUIDITY AND CAPITAL RESOURCES

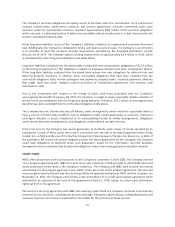

CASH FLOW

Cash provided by operating activities from continuing operations was $272.7 million in 2011, $124.4 million in

2010 and $205.9 million in 2009. Cash provided by operating activities primarily represents income before

depreciation and non-cash charges and after changes in working capital. Working capital is significantly

impacted by changes in inventory and accounts payable. Inventory levels typically increase or decrease to

support expected sales levels, and accounts payable fluctuations are generally determined by the timing of

merchandise purchases and payments. The $148.3 million increase in cash flows from continuing operations in

2011 as compared to 2010 was primarily due to the increase in net income for the period and changes in

working capital. The $81.5 million decrease in cash flows from continuing operations in 2010 as compared to

2009 was primarily the result of changes in working capital, driven by an increase in inventory levels to support

the increased sales for the period.

Cash used in investing activities from continuing operations was $89.4 million in 2011, $55.2 million in 2010,

and $73.9 million in 2009. Cash used in investing activities primarily relates to construction of new stores,

renovation and expansion of existing stores, and investments in support areas (e.g., technology and distribution

centers). The $34.2 million increase in cash used in 2011 was primarily related to an increase of $26.4 million in

capital expenditures for the year and the issuance of a note receivable, net of collections, in the amount of $7.4

million due from Natixis Funding Corporation, the provider of letters of credit required in connection with the

Company’s workers’ compensation and general liability insurance plans. Interest earned on the note receivable

effectively reduces the cost of issuing letters of credit to insurance providers. The $18.7 million decrease in cash

used in 2010 was primarily related to a decrease in capital expenditures for the year.

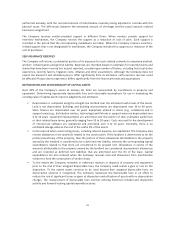

Cash used in financing activities from continuing operations was $181.0 million in 2011, as compared to $18.1

million in 2010 and cash provided by financing activities of $18.8 million in 2009. Cash used in financing

activities in 2011 was primarily due to long-term debt payments resulting from the maturity of $141.6 million of

the Company’s 9.875% senior notes, the redemption of $1.9 million of the Company’s 7.375% senior notes,

$28.9 million of share repurchases made during the year and $3.0 million of debt financing costs incurred in

connection with the amendment of the Company’s revolving credit facility. In 2010, cash used in financing

activities related to the payment of $22.9 million for the 7.5% senior notes that matured in December 2010 and

repurchase of $0.8 million of the Company’s 7.0% senior notes that mature in December 2013. In 2009, cash

provided by financing activities included $120.0 million of proceeds from the issuance of the 7.5% convertible

notes and $95.1 million of proceeds, net of issuance costs, from the issuance of 14.9 million shares of the

Company’s common stock. These inflows were partially offset by the repayment of borrowings under the

revolving credit facility of $156.7 million, the early extinguishment of $23.0 million of the Company’s 7.5%

senior notes due in December 2010, the payment of $13.1 million of financing costs incurred in connection with

the issuance of the Company’s 7.5% convertible notes and an amendment to the revolving credit facility

agreement.

During 2011, the Company repurchased and retired an aggregate of 3.5 million shares of its common stock at an

average price of $8.18 per share and a total cost of $28.9 million. During 2010 and 2009, there were no

repurchases of common stock. As of January 28, 2012, there were approximately 29.2 million shares remaining

available for repurchase under the Company’s existing share repurchase program.

25