Saks Fifth Avenue 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

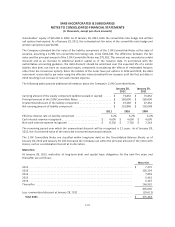

The Company evaluates the realizability of its deferred tax assets on a quarterly basis. In 2011 and 2010, this

evaluation resulted in a net reduction to the reserve against state deferred tax assets of $11,782 and $2,228,

respectively, impacting the Company’s results of operations. A similar analysis was performed in 2009, which

resulted in an additional reserve against state deferred tax assets of $3,045. The Company will continue to

assess the need for additional valuation allowances in the future. If future results are less than projected or tax

planning strategies are no longer viable, then additional valuation allowances may be required to reduce the

deferred tax assets which could have a material impact on the Company’s results of operations in the period in

which it is recorded.

The Company made income tax payments, net of income tax refunds received of $4,776 and $2,191 during 2011

and 2010, respectively. During 2009, the Company received income tax refunds of $4,727, net of income tax

payments.

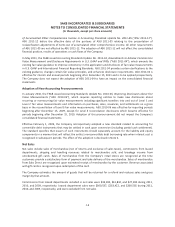

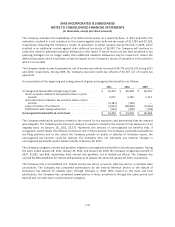

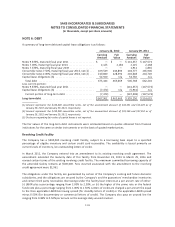

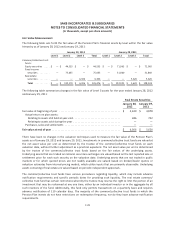

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows:

2011 2010 2009

Unrecognized tax benefits at beginning of year ............... $ 14,254 $ 40,358 $ 46,031

Gross increases related to tax positions taken in prior

periods ........................................... 9,072 3,230 1,111

Gross decreases related to tax positions taken in prior

periods ........................................... (4,131) (165) —

Lapse of statute of limitations ........................... (4,052) (28,860) (6,656)

Settlements with taxing authorities ...................... (919) (309) (128)

Unrecognized tax benefits at end of year ................... $ 14,224 $ 14,254 $ 40,358

The Company analyzed its positions related to the reserve for tax exposures and determined that the amount

was adequate. The Company will continue to analyze its positions related to the reserve for tax exposures on an

ongoing basis. At January 28, 2012, $3,572 represents the amount of unrecognized tax benefits that, if

recognized, would impact the effective income tax rate in future periods. The Company continually evaluates its

tax filing positions and to the extent the Company prevails on audits or statutes of limitation expire, the

unrecognized tax benefits could be realized. The Company does not anticipate any material changes in

unrecognized tax benefits within twelve months of January 28, 2012.

The Company recognizes interest and penalties related to unrecognized tax benefits in income tax expense. During

the years ended January 28, 2012, January 29, 2011, and January 30, 2010, the Company recognized a benefit of

$927, $1,391, and $63, respectively from interest and penalties, net of related tax effects. The Company has

accrued $2,400 and $3,614 for interest and penalties as of January 28, 2012 and January 29, 2011, respectively.

The Company files a consolidated U.S. federal income tax return as well as state tax returns in multiple state

jurisdictions. The Company has completed examinations by the Internal Revenue Service or the statute of

limitations has expired for taxable years through February 2, 2008. With respect to the state and local

jurisdictions, the Company has completed examinations in many jurisdictions through the same period and

beyond and currently has no examinations in progress.

F-18