Saks Fifth Avenue 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

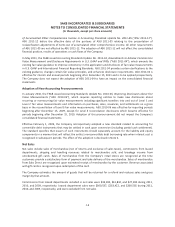

Pension Plans

Pension expense is based on actuarial models used to estimate the total benefits ultimately payable to

participants and is allocated to the respective service periods. The Company’s funding policy provides that

contributions to the pension trusts shall be at least equal to the minimum funding requirement of the Employee

Retirement Income Security Act of 1974. The Company may provide additional contributions from time to time,

generally not to exceed the maximum tax-deductible limitation. The Company’s pension plans are valued

annually as of the fiscal year-end balance sheet date. Actuarial gains and losses are amortized over the average

life expectancy of the plan’s participants, to the extent the cumulative gains or losses exceed 10% of the greater

of the projected benefit obligation or market-related value of plan assets.

Gift Cards

The Company sells gift cards with no expiration dates. At the time gift cards are sold, no revenue is recognized

and a liability is established for the value of the card. The liability is relieved and revenue is recognized when the

gift cards are redeemed by the customer for merchandise. The liability for unredeemed gift cards was $28,933

and $34,241 as of January 28, 2012 and January 29, 2011, respectively and is included in accrued expenses on

the Consolidated Balance Sheets.

The Company periodically evaluates unredeemed gift cards and if it determines that the likelihood of customer

redemption is remote and the gift card is not subject to state escheatment laws, then the Company will

recognize breakage income and reverse the related liability. Breakage income included in net sales during 2011,

2010, and 2009 was $3,112, $3,565, and $5,751, respectively.

Loyalty Program

The Company maintains a customer loyalty program in which customers accumulate points for each qualifying

purchase. On an annual basis, the customers receive a gift card to apply to future purchases. The amount of the

gift card is based on the level of points accumulated during the year. The Company estimates the net cost of

these gift cards that will be earned and redeemed and records this amount in cost of sales as points are

accumulated.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Under this method, deferred

tax assets and liabilities are determined based on differences between the financial reporting and tax bases of

assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the

differences are expected to reverse.

Segment Reporting

SFA, Saks Direct, and OFF 5TH have been aggregated into one reportable segment based on the aggregation

criteria outlined in the authoritative accounting literature.

F-14