Saks Fifth Avenue 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

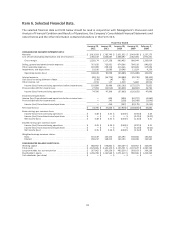

For the year ended January 29, 2011, SG&A was $716.0 million, or 25.7% of net sales, compared to $674.3

million, or 25.6% of net sales, for the year ended January 30, 2010. The increase of $41.6 million in expenses

was primarily driven by higher variable costs associated with the $154.2 million sales increase for the year as

well as incremental expenses incurred to support the growth in Saks Direct. Additionally, the Company

experienced a reduction in proprietary credit card income related to contract changes with HSBC.

OTHER OPERATING EXPENSES

For the year ended January 29, 2011, other operating expenses were $298.1 million, or 10.7% of net sales,

compared to $314.3 million, or 12.0% of net sales, for the year ended January 30, 2010. The decrease of $16.2

million was principally driven by a decrease in depreciation and amortization expense of $16.5 million as a

result of reduced capital expenditures during 2010 and asset impairment charges recorded during the year

ended January 30, 2010. Additionally, the Company incurred lower property and equipment rentals of $3.3

million and a decrease in store pre-opening costs of $1.0 million. These decreases were partially offset by an

increase in taxes other than income taxes of $4.6 million.

IMPAIRMENTS AND DISPOSITIONS

For the year ended January 29, 2011, impairments and dispositions included net charges of $13.1 million

compared to net charges of $29.3 million for the year ended January 30, 2010. The 2010 charges included

closing costs associated with the Plano, Texas; Mission Viejo, California; Southampton, New York; Portland,

Oregon; San Diego, California; and Charleston, South Carolina SFA store closures, the Reno, Nevada OFF 5TH

store closure, and the previously announced agreement to close the Denver, Colorado SFA store during the first

quarter ending April 30, 2011. The Company incurred $12.1 million of store closing-related costs associated with

those locations, including $10.1 million of net lease termination costs, $4.2 million of asset impairment and

disposal costs, $2.5 million of severance costs, and $3.8 million of other store-closing related costs, all of which

were offset in part by a deferred rent benefit of $8.5 million. Also included in impairments and dispositions for

2010 were $1.0 million of asset impairments and dispositions in the normal course of business. The 2009

charges were primarily due to asset impairments and dispositions in the normal course of business.

INTEREST EXPENSE

Interest expense increased to $56.7 million in 2010 from $49.5 million in 2009 and, as a percentage of net sales,

was 2.0% in 2010 and 1.9% in 2009. The increase of $7.2 million was primarily due to the issuance of $120.0

million of convertible notes in May 2009 and the amortization of financing costs associated with these notes

and the amended revolving credit facility. Non-cash interest expense associated with the amortization of the

debt discount on the Company’s convertible notes was $11.9 million and $9.8 million for the years ended

January 29, 2011 and January 30, 2010, respectively.

GAIN (LOSS) ON EXTINGUISHMENT OF DEBT

During the year ended January 29, 2011, the Company repurchased $0.8 million of the 7.0% senior notes which

resulted in a loss on extinguishment of debt of $4.0 thousand. During the year ended January 30, 2010, the

Company extinguished approximately $23.0 million of senior notes. The repurchase of these notes resulted in a

gain on extinguishment of debt of $0.8 million.

OTHER INCOME, NET

Other income decreased to $0.1 million in 2010 from $1.0 million in 2009. Other income in 2010 was primarily

related to $0.7 million of interest income which was offset by $0.6 million of casualty losses relating to the May

2010 flood at the Nashville, Tennessee OFF 5TH store. Other income in 2009 was primarily attributable to

interest income.

INCOME TAXES

For 2010 and 2009, the effective income tax rate for continuing operations differed from the federal statutory

tax rate due to state income taxes and other items such as the change in the valuation allowance against state

24