Redbox 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

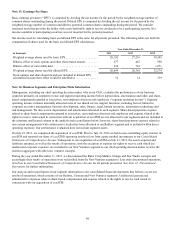

87

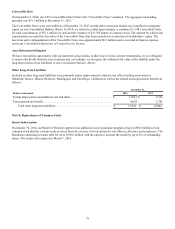

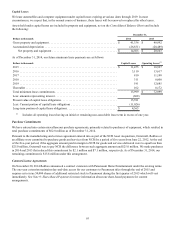

Note 12: Discontinued Operations

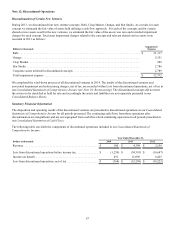

Discontinuation of Certain New Ventures

During 2013, we discontinued four new venture concepts; Rubi, Crisp Market, Orango, and Star Studio. As a result, for each

concept we estimated the fair value of assets held utilizing a cash flow approach. For each of the concepts and for certain

shared service assets used for the new ventures, we estimated the fair value of the assets was zero and recorded impairment

charges for each concept. Total asset impairment charges related to the concepts and relevant shared service assets were

recorded in 2013 as follows:

Dollars in thousands

Impairment

Expense

Rubi . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 21,317

Orango . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,551

Crisp Market. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 289

Star Studio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,786

Corporate assets utilized for discontinued concepts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,789

Total impairment expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 32,732

We completed the wind-down process of all discontinued ventures in 2014. The results of the discontinued ventures and

associated impairment and restructuring charges, net of tax, are recorded within Loss from discontinued operations, net of tax in

our Consolidated Statements of Comprehensive Income (see Note 10: Restructuring). The discontinued concepts did not meet

the criteria to be classified as held for sale and accordingly the assets and liabilities are not separately presented in our

Consolidated Balance Sheets.

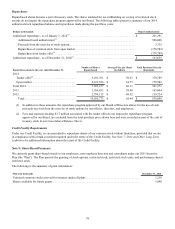

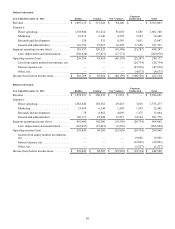

Summary Financial Information

The disposition and operating results of the discontinued ventures are presented in discontinued operations in our Consolidated

Statements of Comprehensive Income for all periods presented. The continuing cash flows from these operations after

discontinuation are insignificant and are not segregated from cash flows from continuing operations in all periods presented in

our Consolidated Statements of Cash Flows.

The following table sets forth the components of discontinued operations included in our Consolidated Statements of

Comprehensive Income:

Year Ended December 31,

Dollars in thousands 2014 2013 2012

Revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 100 $ 4,399 $ 2,159

Loss from discontinued operations before income tax . . . . . . . . . . . . . . . $(1,259)$ (54,395)$ (16,647)

Income tax benefit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 491 21,096 6,425

Loss from discontinued operations, net of tax . . . . . . . . . . . . . . . . . . . . . $(768)$ (33,299)$ (10,222)