Redbox 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

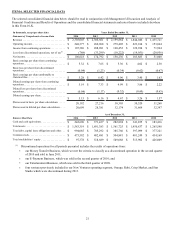

Comparing 2014 to 2013 Continued

Income from continuing operations decreased $100.7 million, or 48.4%, primarily due to:

• $48.7 million increase in loss from equity method investments primarily due to a $68.4 million gain recorded in the

third quarter of 2013 on the re-measurement of our previously held equity interest in ecoATM to its acquisition date

fair value;

• $25.3 million increase in income tax expense due primarily to discrete tax benefits in 2013;

• $14.8 million increase in interest expense due to increased average borrowings which includes the impact of the

$300.0 million principal amount of Senior Notes due 2021 we issued on June 9, 2014 (see Note 7: Debt and Other

Long-Term Liabilities in our Notes to Consolidated Financial Statements for more information); and

• $12.6 million decrease in operating income discussed above.

Comparing 2013 to 2012

Revenue increased $106.7 million, or 4.9%, primarily due to:

• $65.8 million increase from our Redbox segment, $141.7 million from new kiosk installations including the

acquisition and replacement of NCR kiosks, offset by a $75.9 million decrease from a decline in same store sales due

primarily to a lower box office;

• $31.5 million increase from our New Ventures segment primarily due to the inclusion of ecoATM results;

• $9.5 million increase from our Coinstar segment, primarily due to growth of U.S. same store sales as a result of the

price increase in the fourth quarter of 2013 and revenue from kiosks installed at TD Canada Trust ("TDCT") locations.

Operating income decreased $18.4 million, or 6.6%, primarily due to:

• Increased operating loss within our New Ventures segment for 2013, which includes only continuing operations related

to our ecoATM and SAMPLEit concepts, primarily due to the inclusion of ecoATM results subsequent to our

acquisition of ecoATM on July 23, 2013;

• Increased share based expense, which is not allocated to our segments, primarily as a result of $8.7 million in expense

associated with rights to receive cash issued as a part of the acquisition of ecoATM; offset partially by

• Stable operating income in our Redbox segment where revenue growth was offset by:

Increased product costs included in direct operating expenses due to higher content purchases attributable to:

A 19.0% increase in theatrical titles in 2013 driven largely by a weaker release schedule in the third

quarter of 2012 due to the Summer Olympics;

Content purchases in anticipation of higher rental demand, growth in our installed kiosk base,

increased content purchases under our Warner agreement which was signed in the fourth quarter of

2012 relative to the January through October 2012 period when we were procuring Warner content

through alternative sources;

Increased Blu-ray content purchases as we continue to grow this format; partially offset by

A $31.8 million reduction in product costs due to the content library amortization change as

explained in Note 2: Summary of Significant Accounting Policies in our Notes to Consolidated

Financial Statements, as well as a weaker release schedule in the fourth quarter of 2013, down

21.0% from a year ago;