Redbox 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

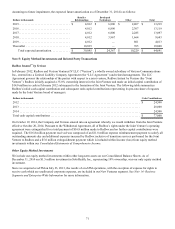

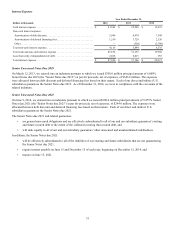

Convertible Debt

On September 2, 2014, our 4.0% Convertible Senior Notes (the “Convertible Notes”) matured. The aggregate outstanding

principal was $51.1 million at December 31, 2013.

The Convertible Notes were convertible as of December 31, 2013 and the debt conversion feature was classified as temporary

equity on our Consolidated Balance Sheets. In 2014, we retired or settled upon maturity, a combined 51,148 Convertible Notes

for total consideration of $51.1 million in cash and the issuance of 431,760 shares of common stock. The amount by which total

consideration exceeded the fair value of the Convertible Notes has been recorded as a reduction of stockholders’ equity. The

loss from early extinguishment of the Convertible Notes was approximately $0.3 million and is recorded in Interest expense,

net in our Consolidated Statements of Comprehensive Income.

Asset Retirement Obligation

We have entered into agreements with our partners to place kiosks in their stores. Upon contract terminations, we are obligated

to remove the kiosks from the store locations and, accordingly, we recognize the estimated fair value of the liability under the

long-term section of our liabilities in our Consolidated Balance Sheets.

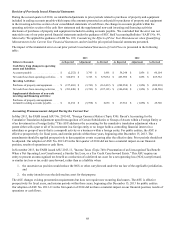

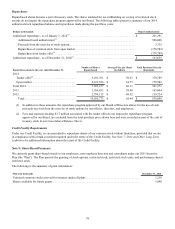

Other Long-Term Liabilities

Included in other long-term liabilities were primarily tenant improvements related to our office building renovation in

Oakbrook Terrace, Illinois; Bellevue, Washington; and San Diego, California as well as the related unrecognized tax benefits as

follows:

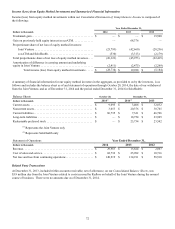

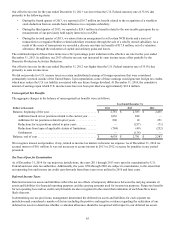

Dollars in thousands

December 31,

2014 2013

Tenant improvement and deferred rent and other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13,013 $ 9,301

Unrecognized tax benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,638 2,781

Total other long-term liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 17,651 $ 12,082

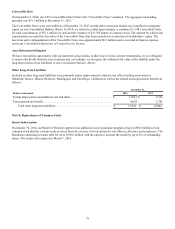

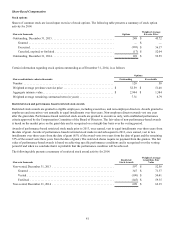

Note 8: Repurchases of Common Stock

Board Authorization

On January 30, 2014, our Board of Directors approved an additional stock repurchase program of up to $500.0 million of our

common stock plus the cash proceeds received from the exercise of stock options by our officers, directors, and employees. The

Board also authorized a tender offer for up to $350.0 million with the option to increase the tender by up to 2% of outstanding

shares. The tender offer expired on March 7, 2014.