Redbox 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126

|

|

$0

$50

$100

$150

$200

$250

$300

12/09 12/10 12/11 12/12 12/13 12/14

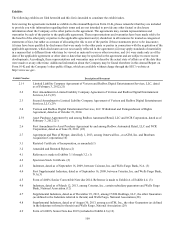

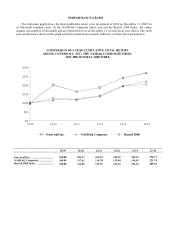

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG OUTERWALL INC., THE NASDAQ COMPOSITE INDEX,

AND THE RUSSELL 2000 INDEX

Outerwall Inc. NASDAQ Composite Russell 2000

PERFORMANCE GRAPH

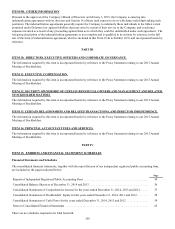

The following graph shows the total stockholder return of an investment of $100 on December 31, 2009 for

(i) Outerwall common stock; (ii) the NASDAQ Composite Index; and (iii) the Russell 2000 Index. All values

assume reinvestment of dividends and are plotted below as of December 31 of each fiscal year shown. The stock

price performance shown in the graph is historical and not necessarily indicative of future price performance.

12/09 12/10 12/11 12/12 12/13 12/14

Outerwall Inc. ................................

NASDAQ Composite .....................

Russell 2000 Index .........................

100.00 203.17 164.29 187.22 242.15 270.77

100.00 117.61 118.70 139.00 196.83 223.74

100.00 126.86 121.56 141.43 196.34 205.95