Redbox 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

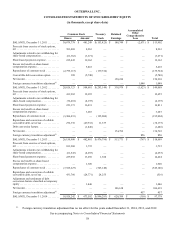

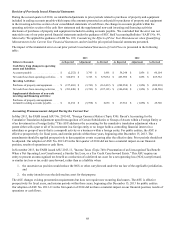

Revision of Previously Issued Financial Statements

During the second quarter of 2014, we identified adjustments to prior periods related to purchases of property and equipment

included in ending accounts payable which impact the amounts presented as cash paid for purchases of property and equipment

in the investing activities section of our consolidated statements of cash flows, the change in accounts payable within the

operating activities section of the cash flow statement and the supplemental non-cash investing and financing activities

disclosure of purchases of property and equipment included in ending accounts payable. We concluded that the error was not

material to any of our prior period financial statements under the guidance of SEC Staff Accounting Bulletin (“SAB”) No. 99,

Materiality. We applied the guidance of SAB No. 108, Considering the Effects of Prior Year Misstatements when Quantifying

Misstatements in the Current Year Financial Statements, and revised the prior period financial statements presented.

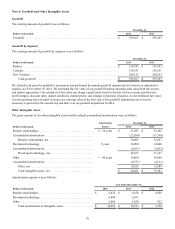

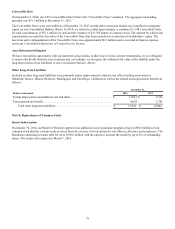

The impact of the immaterial error on our prior period Consolidated Statements of Cash Flows is presented in the following

table:

2013 2012

Dollars in thousands As Reported Adjustment As Revised As Reported Adjustment As Revised

Cash flows from changes in operating

assets and liabilities:

Accounts payable . . . . . . . . . . . . . . . . . . . . $ (2,252) $ 3,743 $ 1,491 $ 58,248 $ 1,856 $ 60,104

Net cash flows from operating activities. . . $ 324,091 $ 3,743 $ 327,834 $ 463,906 $ 1,856 $ 465,762

Investing Activities:

Purchases of property and equipment . . . . . $ (157,669) $ (3,743) $ (161,412) $ (208,054) $ (1,856) $ (209,910)

Net cash flows from investing activities . . . $ (393,448) $ (3,743) $ (397,191) $ (346,650) $ (1,856) $ (348,506)

Supplemental disclosure of non-cash

investing and financing activities:

Purchases of property and equipment

included in ending accounts payable. . . . . . $ 12,254 $ (5,598) $ 6,656 $ 27,562 $ (1,856) $ 25,706

Accounting Pronouncements Adopted During the Current Year

In May 2013, the FASB issued ASU No. 2013-05, "Foreign Currency Matters (Topic 830): Parent’s Accounting for the

Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign Entity or

of an Investment in a Foreign Entity." This ASU addresses the accounting for the cumulative translation adjustment when a

parent either sells a part or all of its investment in a foreign entity or no longer holds a controlling financial interest in a

subsidiary or group of assets that is a nonprofit activity or a business within a foreign entity. For public entities, the ASU is

effective prospectively for fiscal years, and interim periods within those years, beginning after December 15, 2013. The

amendments should be applied prospectively to derecognition events occurring after the effective date. Prior periods should not

be adjusted. Our adoption of ASU No. 2013-05 in the first quarter of 2014 did not have a material impact on our financial

position, results of operations or cash flows.

In November 2013, the FASB issued ASU 2013-11, "Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit

When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists." This ASU requires an

entity to present an unrecognized tax benefit as a reduction of a deferred tax asset for a net operating loss (NOL) carryforward,

or similar tax loss or tax credit carryforward, rather than as a liability when:

1. the uncertain tax position would reduce the NOL or other carryforward under the tax law of the applicable jurisdiction,

and

2. the entity intends to use the deferred tax asset for that purpose.

The ASU changes existing presentation requirements but does not require new recurring disclosures. The ASU is effective

prospectively for fiscal years, and interim periods within those years, beginning after December 15, 2013 for public entities.

Our adoption of ASU No. 2013-11 in the first quarter of 2014 did not have a material impact on our financial position, results of

operations or cash flows.