Redbox 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

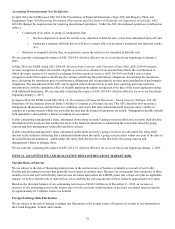

Accounting Pronouncements Not Yet Effective

In April 2014, the FASB issued ASU 2014-08, Presentation of Financial Statements (Topic 205) and Property, Plant, and

Equipment (Topic 360) Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity. ASU

2014-08 changes the requirements for reporting discontinued operations. Under the ASU discontinued operations is defined as

either a:

• Component of an entity, or group of components, that

has been disposed of, meets the criteria to be classified as held-for-sale, or has been abandoned/spun-off; and

represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results,

or a

• Business or nonprofit activity that, on acquisition, meets the criteria to be classified as held-for-sale.

We are currently evaluating the impact of ASU 2014-08, which is effective for us in our fiscal year beginning on January 1,

2015.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09 requires

revenue recognition to depict the transfer of goods or services to customers in an amount that reflects the consideration to

which the entity expects to be entitled in exchange for those goods or services. ASU 2014-09 sets forth a new revenue

recognition model that requires identifying the contract, identifying the performance obligations, determining the transaction

price, allocating the transaction price to performance obligations and recognizing the revenue upon satisfaction of performance

obligations. The amendments in the ASU can be applied either retrospectively to each prior reporting period presented or

retrospectively with the cumulative effect of initially applying the update recognized at the date of the initial application along

with additional disclosures. We are currently evaluating the impact of ASU 2014-09, which is effective for us in our fiscal year

beginning January 1, 2017.

In August 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements - Going Concern (Subtopic 205-40):

Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. This ASU describes how an entity’s

management should assess whether there are conditions and events that raise substantial doubt about an entity’s ability to

continue as a going concern within one year after the date that the financial statements are issued. Management should consider

both quantitative and qualitative factors in making its assessment.

If after considering management’s plans, substantial doubt about an entity’s going concern is alleviated, an entity shall disclose

information in the footnotes that enables the users of the financial statements to understand the events that raised the going

concern and how management’s plan alleviated this concern.

If after considering management’s plans, substantial doubt about an entity’s going concern is not alleviated, the entity shall

disclose in the footnotes indicating that a substantial doubt about the entity’s going concern exists within one year of the date of

the issued financial statements. Additionally, the entity shall disclose the events that led to this going concern and

management’s plans to mitigate them.

We are currently evaluating the impact of ASU 2014-15, which is effective for us in our fiscal year beginning January 1, 2016.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Variable Rates of Interest

We are subject to the risk of fluctuating interest rates in the normal course of business, primarily as a result of our Credit

Facility and investment activities that generally bear interest at variable rates. Because our investments have maturities of three

months or less and our Credit Facility interest rates are based upon either the LIBOR, prime rate or base rate plus an applicable

margin, we believe that the risk of material loss is low and that the carrying amount of these balances approximates fair value.

Based on the principal balance of our outstanding term loans of $146.3 million as of December 31, 2014, an increase or

decrease of one percentage point in the interest rate over the next year would increase or decrease our annual interest expense

by approximately $1.5 million, before tax benefits.

Foreign Exchange Rate Fluctuation

We are subject to the risk of foreign exchange rate fluctuation in the normal course of business as a result of our operations in

the United Kingdom, Ireland, and Canada.