Redbox 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

Notes Receivable

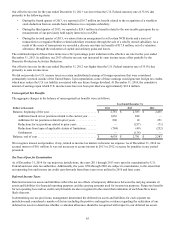

On June 9, 2011, we completed the sale transaction of the Money Transfer Business to Sigue Corporation (“Sigue”). We

received $19.5 million in cash and a note receivable of $29.5 million (the “Sigue Note”). In December 2011, as part of the sale

transaction, we were required to provide Sigue with an additional loan of $4.0 million under terms consistent with the Sigue

Note. We estimated the fair value of the Sigue Note based on the future note payments discounted at a market rate for similar

risk profile companies, approximately 18.0%, which reflected our best estimate of default risk, and was not an exit price based

measure of fair value or the stated value on the face of the Sigue Note. We evaluated the Sigue Note for collectability on a

quarterly basis. Our evaluation at September 30, 2013 included consideration of ongoing discussions surrounding early

payment on the note and certain indemnification obligations we have previously undertaken, as a result of our evaluation we

did not record interest income on the note and also recorded a charge of $2.8 million against the note balance to arrive at a

carrying value which approximated its estimated fair value. During the fourth quarter of 2013, we received $24.8 million in

cash from Sigue for full settlement of the Sigue Note, interest and a release of certain indemnification claims. We recorded a

benefit of $2.5 million from the release of indemnification related reserves.

Fair Value of Other Financial Instruments

The carrying value of our term loans approximates their fair value and falls under Level 2 of the fair value hierarchy.

We estimated the fair value of our convertible debt outstanding using a market rate of approximately 6.0% for similar high-

yield debt at December 31, 2013. The estimated fair value of our convertible debt was approximately $50.5 million at

December 31, 2013, and was determined based on its stated terms, maturing on September 1, 2014, and an annual interest rate

of 4.0%. The fair value estimate of our convertible debt falls under Level 3 of the fair value hierarchy. We have reported the

carrying value of our convertible debt, face value less the unamortized debt discount, in our Consolidated Balance Sheets.

We estimated the fair value of our senior unsecured notes due 2019 and 2021 outstanding using market rates of approximately

6.0% and 5.875%, respectively, for similar high-yield debt at December 31, 2014. We estimated the fair value of our senior

unsecured notes due 2019 outstanding using a market rate of approximately 6.0% for similar high-yield debt at December 31,

2013. The estimated fair value of our senior unsecured notes due 2019 and 2021 was approximately $350.0 million and

$300.0 million, respectively, at December 31, 2014. The estimated fair value of our senior unsecured notes due 2019 was

approximately $350.0 million at December 31, 2013. These estimated fair values for our senior unsecured notes due 2019 and

2021 were determined based on their stated terms, maturing on March 15, 2019, and June 15, 2021, respectively, and annual

interest rates of 6.0% and 5.875%. The fair value estimate of our senior unsecured notes falls under Level 3 of the fair value

hierarchy. We have reported the carrying value, face value less the unamortized debt discount, of our senior unsecured notes,

issued at par, in our Consolidated Balance Sheets.

Note 17: Commitments and Contingencies

Lease Commitments

Operating Leases

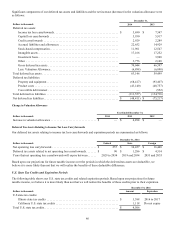

We lease our corporate administrative, marketing, and product development facilities in Bellevue, Washington under operating

leases that expire December 31, 2019 and December 31, 2017.

We lease our Redbox facility in Oakbrook Terrace, Illinois under an operating lease that expires on July 31, 2021. Under certain

circumstances, we have the ability to extend the lease for a five-year period, rent additional office space under a right of first

offer and refusal and have the option to terminate the lease in July 2016. Under the terms of the lease, we are responsible for

certain tax, construction and operating costs associated with the rented space.

During 2014 we consolidated our ecoATM business offices and facilities into one new location in San Diego, California. The

lease for the space we vacated during 2014 will expire in 2015. The new location occupies 53,512 square feet and consists of

facilities supporting administration, marketing, engineering, customer service and inventory processing. The lease for this space

will expire on October 31, 2024.

Rent expense under our operating lease agreements was $16.8 million, $12.3 million and $9.0 million during 2014, 2013 and

2012, respectively.