Redbox 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

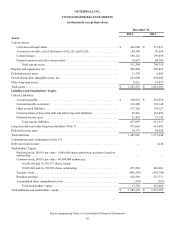

46

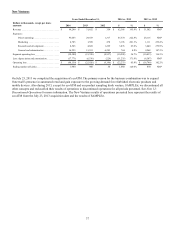

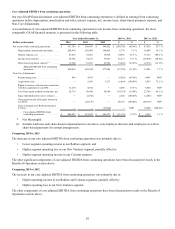

Dollars in thousands

Senior

Unsecured

Notes due 2019

Credit Facility

Term Loans

Convertible

Notes Total Debt

As of December 31, 2013:

Principal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 350,000 $ 344,375 $ 51,148 $ 745,523

Discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,317) — (1,446) (6,763)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 344,683 344,375 49,702 738,760

Less: current portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (42,187) (49,702) (91,889)

Total long-term portion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 344,683 $ 302,188 $ — $ 646,871

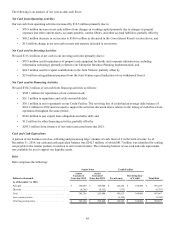

Senior Unsecured Notes Due 2019

On March 12, 2013, we entered into an indenture pursuant to which we issued $350.0 million principal amount of 6.000%

Senior Notes due 2019 (the “Senior Notes due 2019”) at par for proceeds, net of expenses, of $343.8 million. The expenses

were allocated between debt discount and deferred financing fees based on their nature. Each of our direct and indirect U.S.

subsidiaries guarantees the Senior Notes due 2019. As of December 31, 2014, we were in compliance with the covenants of the

related indenture.

Senior Unsecured Notes Due 2021

On June 9, 2014, we entered into an indenture pursuant to which we issued $300.0 million principal amount of 5.875% Senior

Notes due 2021 (the "Senior Notes due 2021") at par for proceeds, net of expenses, of $294.0 million. The expenses were

allocated between debt discount and deferred financing fees based on their nature. Each of our direct and indirect U.S.

subsidiaries guarantees the Senior Notes due 2021.

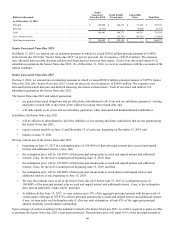

The Senior Notes due 2021 and related guarantees:

• are general unsecured obligations and are effectively subordinated to all of our and our subsidiary guarantors’ existing

and future secured debt to the extent of the collateral securing that secured debt, and

• will rank equally to all of our and our subsidiary guarantors’ other unsecured and unsubordinated indebtedness.

In addition, the Senior Notes due 2021:

• will be effectively subordinated to all of the liabilities of our existing and future subsidiaries that are not guaranteeing

the Senior Notes due 2021,

• require interest payable on June 15 and December 15 of each year, beginning on December 15, 2014, and

• mature on June 15, 2021.

We may redeem any of the Senior Notes due 2021:

• beginning on June 15, 2017 at a redemption price of 104.406% of their principal amount plus accrued and unpaid

interest and additional interest, if any; then

• the redemption price will be 102.938% of their principal amount plus accrued and unpaid interest and additional

interest, if any, for the twelve-month period beginning June 15, 2018; then

• the redemption price will be 101.469% of their principal amount plus accrued and unpaid interest and additional

interest, if any, for the twelve-month period beginning June 15, 2019; and then

• the redemption price will be 100.000% of their principal amount plus accrued interest and unpaid interest and

additional interest, if any, beginning on June 15, 2020.

• We may also redeem some or all of the Senior Notes due 2021 before June 15, 2017 at a redemption price of

100.000% of the principal amount, plus accrued and unpaid interest and additional interest, if any, to the redemption

date, plus an applicable “make-whole” premium.

• In addition, before June 15, 2017, we may redeem up to 35% of the aggregate principal amount with the proceeds of

certain equity offerings at 105.875% of their principal amount plus accrued and unpaid interest and additional interest,

if any; we may make such redemption only if, after any such redemption, at least 65% of the aggregate principal

amount originally issued remains outstanding.

Upon a change of control as defined in the indenture related to the Senior Notes due 2021, we will be required to make an offer

to purchase the Senior Notes due 2021 or any portion thereof. That purchase price will equal 101% of the principal amount of