Redbox 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

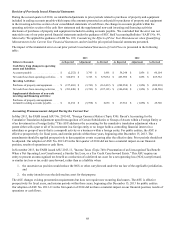

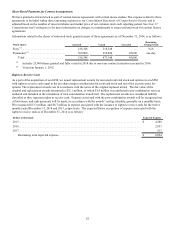

75

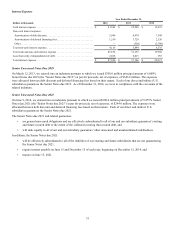

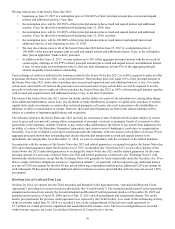

Interest Expense

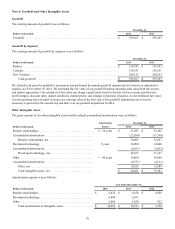

Dollars in thousands

Year Ended December 31,

2014 2013 2012

Cash interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 41,562 $ 25,289 $ 12,833

Non-cash interest expense:

Amortization of debt discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,606 4,674 7,109

Amortization of deferred financing fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,510 1,720 2,126

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (550) (2,700)

Total non-cash interest expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,116 5,844 6,535

Total cash and non-cash interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,678 31,133 19,368

Loss from early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,018 6,013 953

Total interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 47,696 $ 37,146 $ 20,321

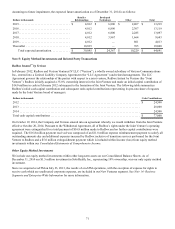

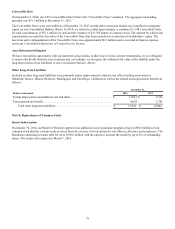

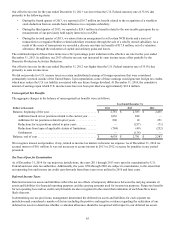

Senior Unsecured Notes Due 2019

On March 12, 2013, we entered into an indenture pursuant to which we issued $350.0 million principal amount of 6.000%

Senior Notes due 2019 (the “Senior Notes due 2019”) at par for proceeds, net of expenses, of $343.8 million. The expenses

were allocated between debt discount and deferred financing fees based on their nature. Each of our direct and indirect U.S.

subsidiaries guarantees the Senior Notes due 2019. As of December 31, 2014, we were in compliance with the covenants of the

related indenture.

Senior Unsecured Notes Due 2021

On June 9, 2014, we entered into an indenture pursuant to which we issued $300.0 million principal amount of 5.875% Senior

Notes due 2021 (the "Senior Notes due 2021") at par for proceeds, net of expenses, of $294.0 million. The expenses were

allocated between debt discount and deferred financing fees based on their nature. Each of our direct and indirect U.S.

subsidiaries guarantees the Senior Notes due 2021.

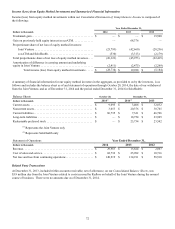

The Senior Notes due 2021 and related guarantees:

• are general unsecured obligations and are effectively subordinated to all of our and our subsidiary guarantors’ existing

and future secured debt to the extent of the collateral securing that secured debt, and

• will rank equally to all of our and our subsidiary guarantors’ other unsecured and unsubordinated indebtedness.

In addition, the Senior Notes due 2021:

• will be effectively subordinated to all of the liabilities of our existing and future subsidiaries that are not guaranteeing

the Senior Notes due 2021,

• require interest payable on June 15 and December 15 of each year, beginning on December 15, 2014, and

• mature on June 15, 2021.