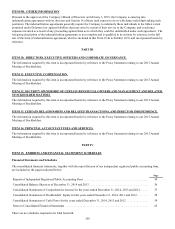

Redbox 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

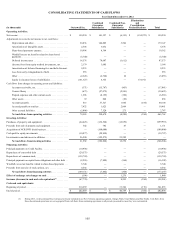

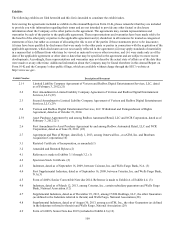

CONSOLIDATING STATEMENTS OF CASH FLOWS

Year Ended December 31, 2013

(in thousands) Outerwall Inc.

Combined

Guarantor

Subsidiaries

Combined Non-

Guarantor

Subsidiaries

Eliminations

and

Consolidation

Reclassifications Total

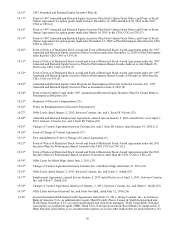

Operating Activities:

Net income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 174,792 $ 109,682 $ (11,037) $ (98,645) $ 174,792

Adjustments to reconcile net income to net cash flows

from operating activities:

Depreciation and other . . . . . . . . . . . . . . . . . . . . . 29,640 158,801 5,259 — 193,700

Amortization of intangible assets . . . . . . . . . . . . . 2,245 8,688 — — 10,933

Share-based payments expense . . . . . . . . . . . . . . 9,903 6,928 — — 16,831

Windfall excess tax benefits related to share-

based payments. . . . . . . . . . . . . . . . . . . . . . . . . . . (3,698) — — — (3,698)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . 9,228 (15,727) (4,434) — (10,933)

Impairment Expense. . . . . . . . . . . . . . . . . . . . . . . 32,444 288 — — 32,732

Loss (income) from equity method investments,

net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (65,063) 45,135 — — (19,928)

Amortization of deferred financing fees and debt

discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,394———6,394

Loss from early extinguishment of debt. . . . . . . . 6,013———6,013

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 827 (2,951) 31 54 (2,039)

Equity in (income) losses of subsidiaries . . . . . . . (109,682) 11,037 — 98,645 —

Cash flows from changes in operating assets and

liabilities:

Accounts receivable, net. . . . . . . . . . . . . . . . . . . . (1,144) 10,639 (1,517) — 7,978

Content library . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,093 (23,357) (195) — (22,459)

Prepaid expenses and other current assets . . . . . . (43,762) (6,280) (500) — (50,542)

Other assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 201 400 (371) — 230

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . 1,319 (408) 226 354 1,491

Accrued payable to retailers . . . . . . . . . . . . . . . . . (6,181) 1,633 460 — (4,088)

Other accrued liabilities . . . . . . . . . . . . . . . . . . . . 13,184 (22,751) (6) — (9,573)

Net cash flows from (used in) operating

activities(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57,753 281,757 (12,084) 408 327,834

Investing Activities:

Purchases of property and equipment . . . . . . . . . . . . . . (58,763) (88,431) (14,218) — (161,412)

Proceeds from sale of property and equipment . . . . . . . 12,147 1,189 8 — 13,344

Acquisition of ecoATM, net of cash acquired. . . . . . . . (244,036) — — — (244,036)

Receipt of note receivable principal . . . . . . . . . . . . . . . 22,913———22,913

Cash paid for equity investments . . . . . . . . . . . . . . . . . — (28,000) — — (28,000)

Investments in and advances to affiliates . . . . . . . . . . . 125,856 (156,659) 30,857 (54) —

Net cash flows from (used in) investing

activities(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (141,883) (271,901) 16,647 (54) (397,191)

Financing Activities:

Proceeds from issuance of senior unsecured notes . . . . 343,769———343,769

Proceeds from new borrowing on Credit Facility . . . . . 400,000———400,000

Principal payments on Credit Facility . . . . . . . . . . . . . . (215,313) — — — (215,313)

Financing costs associated with Credit Facility and

senior unsecured notes. . . . . . . . . . . . . . . . . . . . . . . . . . (2,203) — — — (2,203)

Conversion of convertible debt . . . . . . . . . . . . . . . . . . . (172,211) — — — (172,211)

Repurchases of common stock . . . . . . . . . . . . . . . . . . . (195,004) — — — (195,004)

Principal payments on capital lease obligations and

other debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,200) (217) (417) — (14,834)

Windfall excess tax benefits related to share-based

payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,698———3,698

Withholding tax paid on vesting of restricted stock net

of proceeds from exercise of stock options . . . . . . . . . . 8,460———8,460

Net cash flows from (used in) financing

activities(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156,996 (217) (417) — 156,362