Redbox 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

Use of Estimates in Financial Reporting

We prepare our financial statements in conformity with accounting principles generally accepted in the U.S. which requires

management to make estimates and assumptions that affect the reported amounts in our consolidated financial statements and

our notes thereto. The most significant estimates and assumptions include the:

• useful lives and salvage values of our content library;

• determination of goodwill impairment;

• lives and recoverability of equipment and other long-lived assets;

• recognition and measurement of current and long-term deferred income taxes (including the measurement of uncertain

tax positions); and

• loss contingencies.

It is reasonably possible that the estimates we make may change in the future and could have a material effect on our financial

statements.

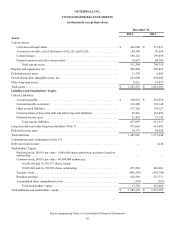

Cash and Cash Equivalents

We consider all highly liquid investments with an original maturity of three months or less to be cash equivalents. Our cash and

cash equivalents were $242.7 million and $371.4 million at December 31, 2014, and December 31, 2013, respectively. Of this

total, cash equivalents were $0.9 million and $65.8 million, respectively, and consisted of money market demand accounts and

investment grade fixed income securities such as money market funds, certificate of deposits, and commercial paper. Our cash

balances with financial institutions may exceed the deposit insurance limits.

Included in our cash and cash equivalents at December 31, 2014, and December 31, 2013, were $81.7 million and

$85.5 million, respectively that we identified for settling our accrued payable to our retailer partners in relation to our Coinstar

kiosks.

Separately included in our cash and cash equivalents at December 31, 2014, and December 31, 2013, were $66.5 million and

$199.0 million, respectively in cash and cash equivalents held in financial institutions domestically and $11.6 million and

$15.2 million, respectively in cash and cash equivalents held in foreign financial institutions.

Accounts Receivable

Accounts receivable represents receivables, net of allowances for doubtful accounts. The allowance for doubtful accounts

reflects our best estimate of probable losses inherent in the accounts receivable balance. We determine the allowance based on

historical experience and other currently available information. When a specific account is deemed uncollectible, the account is

written off against the allowance. Amounts expensed for uncollectible accounts and amounts charged against the allowance

were immaterial in all periods presented.

Content Library

Content library consists of movies and video games available for rent or purchase. We obtain our movie and video game

content primarily through revenue sharing agreements and license agreements with studios and game publishers, as well as

through distributors and other suppliers. The cost of content mainly includes the cost of the movies and video games, labor,

overhead, freight, and studio revenue sharing expenses. The content purchases are capitalized and amortized to their estimated

salvage value as a component of direct operating expenses over the usage period. For purchased content that we expect to sell

at the end of its useful life, we determine an estimated salvage value. Content salvage values are estimated based on the

amounts that we have historically recovered on disposal. For licensed content that we do not expect to sell, no salvage value is

provided. The useful lives and salvage value of our content library are periodically reviewed and evaluated. Amortization

charges are derived utilizing rental curves based on historical performance of movies and games over their useful lives and

recorded on an accelerated basis, reflecting higher rentals of movies and video games in the first few weeks after release, and

substantially all of the amortization expense is recognized within one year of purchase.