Redbox 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

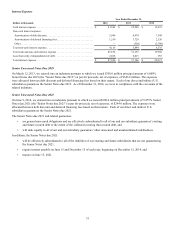

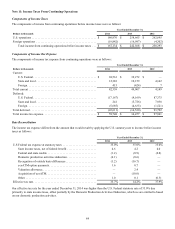

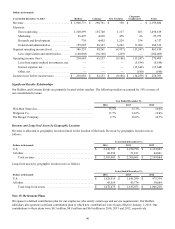

Note 11: Income Taxes From Continuing Operations

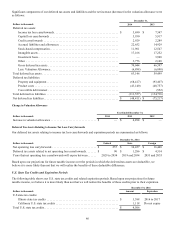

Components of Income Taxes

The components of income from continuing operations before income taxes were as follows:

Year Ended December 31,

Dollars in thousands 2014 2013 2012

U.S. operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 186,976 $ 258,665 $ 262,695

Foreign operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (19,842)(16,097)(4,302)

Total income from continuing operations before income taxes . . . $ 167,134 $ 242,568 $ 258,393

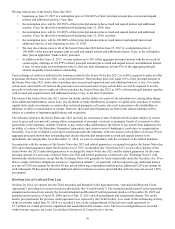

Components of Income Tax Expense

The components of income tax expense from continuing operations were as follows:

Year Ended December 31,

Dollars in thousands 2014 2013 2012

Current:

U.S. Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 69,561 $ 39,272 $ —

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,383 10,159 4,142

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 415 (424)7

Total current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82,359 49,007 4,149

Deferred:

U.S. Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17,167)(4,169) 87,375

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 241 (5,726) 7,938

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,685)(4,635)(1,521)

Total deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22,611)(14,530) 93,792

Total income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 59,748 $ 34,477 $ 97,941

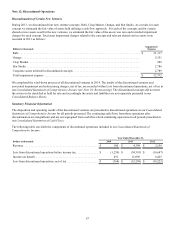

Rate Reconciliation

The income tax expense differs from the amount that would result by applying the U.S. statutory rate to income before income

taxes as follows:

Year Ended December 31,

2014 2013 2012

U.S Federal tax expense at statutory rates . . . . . . . . . . . . . . . . . . . . . . . 35.0% 35.0% 35.0%

State income taxes, net of federal benefit . . . . . . . . . . . . . . . . . . . . 4.6 4.2 4.0

Federal and state credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.2)(0.9)(0.8)

Domestic production activities deduction . . . . . . . . . . . . . . . . . . . . (4.1)(0.6)—

Recognition of outside basis differences. . . . . . . . . . . . . . . . . . . . . (1.2)(16.7)—

ecoATM option payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6 0.7 —

Valuation allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2.4 —

Acquisition of ecoATM. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (10.0)—

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.0 0.1 (0.3)

Effective tax rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.7% 14.2% 37.9%

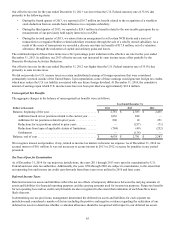

Our effective tax rate for the year ended December 31, 2014 was higher than the U.S. Federal statutory rate of 35.0% due

primarily to state income taxes, offset partially by the Domestic Production Activities Deduction, which we are entitled to based

on our domestic production activities.