Redbox 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

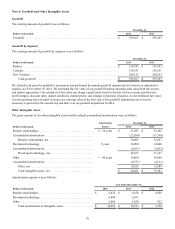

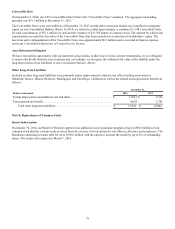

Note 4: Goodwill and Other Intangible Assets

Goodwill

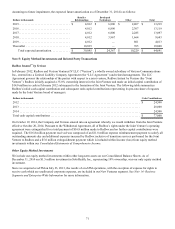

The carrying amount of goodwill was as follows:

Dollars in thousands

December 31,

2014 2013

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 559,307 $ 559,307

Goodwill by Segment

The carrying amount of goodwill by segment was as follows:

Dollars in thousands

December 31,

2014 2013

Redbox . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 138,743 $ 138,743

Coinstar. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156,351 156,351

New Ventures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 264,213 264,213

Total goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 559,307 $ 559,307

We elected to by-pass the qualitative assessment and performed the annual goodwill impairment test based on a quantitative

analysis as of November 30, 2014. We estimated the fair value of our goodwill bearing reporting units using both the income

and market approaches. Our estimates of fair value can change significantly based on factors such as revenue growth rates,

profit margins, discount rates, market conditions, market prices, and changes in business strategies. As the estimated fair value

of each reporting unit exceeded its respective carrying value in the first step of the goodwill impairment test it was not

necessary to proceed to the second step and there was no goodwill impairment in 2014.

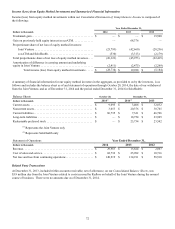

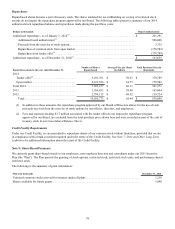

Other Intangible Assets

The gross amount of our other intangible assets and the related accumulated amortization were as follows:

Dollars in thousands

Amortization December 31,

Period 2014 2013

Retailer relationships. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 - 10 years $ 53,295 $ 53,295

Accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (23,200)(17,768)

Retailer relationships, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,095 35,527

Developed technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 years 34,000 34,000

Accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,633)(2,833)

Developed technology, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,367 31,167

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 - 40 years 16,800 16,800

Accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,571)(4,111)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,229 12,689

Total intangible assets, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 64,691 $ 79,383

Amortization expense was as follows:

Year Ended December 31,

Dollars in thousands 2014 2013 2012

Retailer relationships. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,432 $ 6,250 $ 4,456

Developed technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,800 2,833 —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,460 1,850 922

Total amortization of intangible assets . . . . . . . . . . . . . . . . . . . . $ 14,692 $ 10,933 $ 5,378