Redbox 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

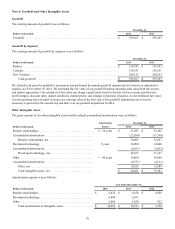

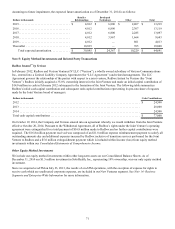

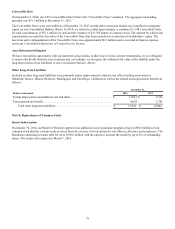

Assuming no future impairment, the expected future amortization as of December 31, 2014 is as follows:

Dollars in thousands

Retailer

Relationships

Developed

Technology Other Total

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,012 $ 6,800 $ 2,407 $ 13,219

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 6,800 2,307 13,119

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 6,800 2,285 13,097

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 3,967 1,664 9,643

2019. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 — 801 4,813

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,035 — 765 10,800

Total expected amortization. . . . . . . . . . . . . $ 30,095 $ 24,367 $ 10,229 $ 64,691

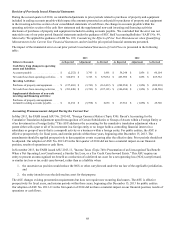

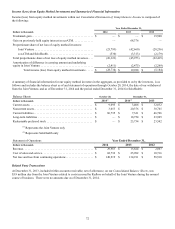

Note 5: Equity Method Investments and Related Party Transactions

Redbox Instant™ by Verizon

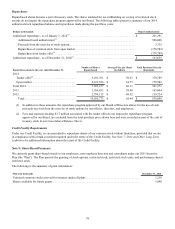

In February 2012, Redbox and Verizon Ventures IV LLC (“Verizon”), a wholly owned subsidiary of Verizon Communications

Inc., entered into a Limited Liability Company Agreement (the “LLC Agreement”) and related arrangements. The LLC

Agreement governs the relationship of the parties with respect to a joint venture, Redbox Instant by Verizon (the “Joint

Venture”). Redbox initially acquired a 35.0% ownership interest in the Joint Venture and made an initial capital contribution of

$14.0 million in cash in February 2012 subsequent to the formation of the Joint Venture. The following table summarizes

Redbox's initial cash capital contribution and subsequent cash capital contributions representing its pro-rata share of requests

made by the Joint Venture board of managers:

Dollars in thousands Cash Contributions

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 24,500

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,000

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,500

Total cash capital contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 77,000

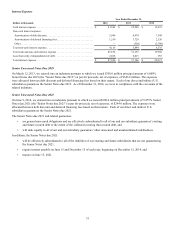

On October 19, 2014, the Company and Verizon entered into an agreement whereby we would withdraw from the Joint Venture

effective October 20, 2014. Pursuant to the Withdrawal Agreement, all of Redbox’s rights under the Joint Venture’s operating

agreement were extinguished for a total payment of $16.8 million made to Redbox and no further capital contributions were

required. The $16.8 million payment received was composed of an $11.8 million expense reimbursement payment to satisfy all

outstanding amounts due and additional expenses incurred by Redbox inclusive of transition services performed for the Joint

Venture to Redbox and a $5.0 million extinguishment payment which is included within Income (loss) from equity method

investments within our Consolidated Statements of Comprehensive Income.

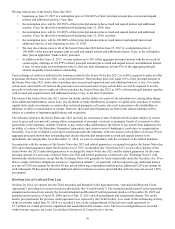

Other Equity Method Investments

We include our equity method investments within other long-term assets on our Consolidated Balance Sheets. As of

December 31, 2014 our $1.5 million investment in SoloHealth, Inc., representing 10% ownership, was our only equity method

investment.

Since we acquired ecoATM on July 23, 2013, the results of ecoATM operations, with the exception of expense for rights to

receive cash which are unallocated corporate expenses, are included in our New Ventures segment. See Note 14: Business

Segments and Enterprise-Wide Information for more information.