Redbox 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

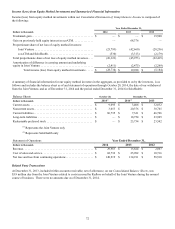

Foreign Currency Translation

The functional currencies of our international subsidiaries are the British pound Sterling for our subsidiary Coinstar Limited in

the United Kingdom, Canadian dollar for Coinstar International and Redbox Canada GP, and the Euro for our Coinstar Ireland

Limited subsidiary. We translate assets and liabilities related to these operations to U.S. dollars at the exchange rate in effect at

the date of the Consolidated Balance Sheets; we convert revenues and expenses into U.S. dollars using average exchange rates.

Transaction gains and losses including on foreign currency intercompany transactions not deemed to be of a long term

investment nature are included in Other income (expense), net on our Consolidated Statements of Comprehensive Income.

Translation gains and losses, including gains and losses on foreign currency intercompany transactions deemed to be of a long

term investment nature, are reported as Accumulated other comprehensive loss in our Consolidated Balance Sheets.

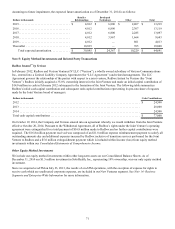

Share-Based Payments

We measure and recognize expense for all share-based payment awards granted, including employee stock options and

restricted stock awards, based on the estimated fair value of the award on the grant date. We utilize the Black-Scholes-Merton

(“BSM”) valuation model for valuing our stock option awards and the determination of the expenses.

The use of the BSM valuation model to estimate the fair value of stock option awards requires us to make judgments on

assumptions regarding the risk-free interest rate, expected dividend yield, expected term and expected volatility over the

expected term of the award. The assumptions used in calculating the fair value of share-based payment awards represent

management’s best estimates at the time they are made, but these estimates involve inherent uncertainties and the determination

of expense could be materially different in the future.

We amortize share-based payment expense on a straight-line basis over the vesting period of the individual award with

estimated forfeitures considered. Vesting periods are generally four years. Expense for performance based shares is recognized

over the vesting period if and when we conclude that it is probable that the performance condition will be achieved. We

reassess the probability of vesting at each reporting period for awards with performance conditions and adjust compensation

cost based on our probability assessment.

Shares to be issued upon the exercise of stock options will come from newly issued shares. The expense related to restricted

stock granted to movie studios as part of license agreements is adjusted based on the number of unvested shares and market

price of our common stock each reporting period.

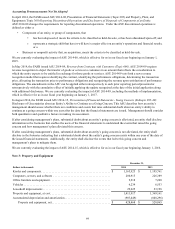

Share-based payment expense is only recognized on awards that ultimately vest. Therefore, we have reduced the share-based

payment expense to be recognized over the vesting period for anticipated future forfeitures. Forfeiture estimates are based on

historical forfeiture patterns. We review and assess our forfeiture estimates quarterly and update them if necessary. Any changes

to accumulated share-based payment expense are recognized in the period of change. If actual forfeitures differ significantly

from our estimates, our results of operations could be materially impacted. For additional information see Note 9: Share-Based

Payments.

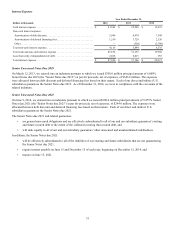

Fair Value of Financial Instruments

The carrying amounts for cash equivalents approximate fair value, which is the amount for which the instrument could be

exchanged in a current transaction between willing parties. Available-for-sale securities are marked to fair value on a quarterly

basis. The fair value of our revolving line of credit approximates its carrying amount. For additional information see Note 16:

Fair Value.

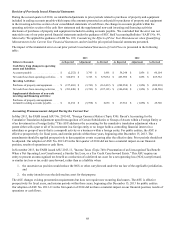

Reclassifications

During 2014, we reclassified certain deferred fees associated with the issuance of our Senior Notes due 2019 from other long-

term assets to long-term debt and other long-term liabilities. We have reclassified these amounts for all periods presented in our

Consolidated Balance Sheets.

During 2013, we discontinued four new venture concepts, Rubi, Crisp Market, Orango, and Star Studio. We have reclassified

the results of operations of these four ventures to discontinued operations for all periods presented in our Consolidated

Statements of Comprehensive Income. See Note 12: Discontinued Operations for more information.

The accompanying consolidated financial statements include the accounts of Outerwall Inc. and our wholly-owned subsidiaries.

Investments in companies of which we may have significant influence, but not a controlling interest, are accounted for using the

equity method of accounting. All significant intercompany balances and transactions have been eliminated in consolidation.