Redbox 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

Market Information and Stock Prices

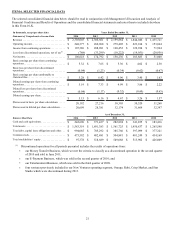

Our common stock is traded on the NASDAQ Global Select Market under the symbol “OUTR.” The following table sets forth

the high and low sale prices per share as reported by the NASDAQ Global Select Market for our common stock for each

quarter during the last two fiscal years. The quotations represent inter-dealer prices without retail markup, markdown or

commission and may not necessarily represent actual transactions.

2014 High Low

Quarter 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 74.30 $ 62.60

Quarter 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 72.85 $ 57.36

Quarter 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 62.49 $ 52.72

Quarter 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 76.38 $ 51.17

2013

Quarter 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 59.16 $ 46.83

Quarter 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 61.29 $ 50.70

Quarter 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 65.60 $ 46.25

Quarter 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 72.09 $ 49.97

The approximate number of holders of record of our common stock at February 3, 2015 was 79.

Dividends

Although we have never declared or paid any cash dividends on our common stock, on February 5, 2015, we announced that

the Board of Directors has decided to initiate a quarterly cash dividend. The first cash dividend of $0.30 per outstanding share

of our common stock is expected to be paid on March 18, 2015 to all stockholders of record on March 3, 2015. While it is our

intention to pay quarterly cash dividends for the foreseeable future, the decision to pay future cash dividends will be made by

our Board of Directors each quarter and will depend upon, among other things, existing conditions, including earnings,

financial condition and capital requirements, restrictions in financing agreements, business opportunities and other conditions

and factors, including prospects. We are required to meet certain financial covenants under our Credit Facility and the

indentures related to the Senior Notes due 2019 and the Senior Notes due 2021 in order to pay dividends. We were in

compliance with these financial covenants at December 31, 2014.

Repurchases of Common Stock

On January 30, 2014, our Board of Directors approved an additional stock repurchase program of up to $500.0 million of our

common stock plus the cash proceeds received from the exercise of stock options by our officers, directors, and employees. The

Board also authorized a tender offer for up to $350.0 million with the option to increase the tender by up to 2% of outstanding

shares.

As of December 31, 2014, we were authorized to repurchase up to $163.7 million of our common stock under our share

repurchase programs. Repurchased shares become a part of treasury stock.