Redbox 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

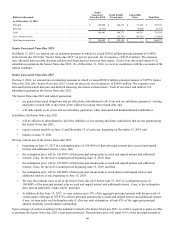

43

Core Diluted EPS from continuing operations

Our non-GAAP financial measure core diluted EPS from continuing operations is defined as diluted earnings per share from

continuing operations excluding Non-Core Adjustments, net of applicable taxes.

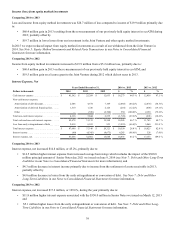

A reconciliation of core diluted EPS from continuing operations to diluted EPS from continuing operations, the most

comparable GAAP financial measure, is presented in the following table:

Year Ended December 31, 2014 vs. 2013 2013 vs. 2012

2014 2013 2012 $%$%

Diluted EPS from continuing operations . . . . . . . $ 5.19 $ 7.33 $ 4.99 $ (2.14) (29.2)% $ 2.34 46.9 %

Non-Core Adjustments, net of tax:(1)

Restructuring costs . . . . . . . . . . . . . . . . . . . 0.01 0.10 — (0.09) (90.0)% 0.10 NM*

Acquisition costs . . . . . . . . . . . . . . . . . . . . . — 0.17 0.06 (0.17) (100.0)% 0.11 183.3 %

Rights to receive cash issued in connection

with the acquisition of ecoATM . . . . . . . . . 0.53 0.25 — 0.28 112.0 % 0.25 NM*

Loss from equity method investments. . . . . 0.85 1.04 0.47 (0.19) (18.3)% 0.57 121.3 %

Sigue indemnification reserve releases . . . . — (0.05) — 0.05 (100.0)% (0.05) NM*

Gain on previously held equity interest on

ecoATM. . . . . . . . . . . . . . . . . . . . . . . . . . . . — (2.33) — 2.33 (100.0)% (2.33) NM*

Gain on formation of Redbox Instant by

Verizon. . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (0.37) — NM* 0.37 (100.0)%

Tax benefit from net operating loss

adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . (0.05) — — (0.05) NM* — NM*

Tax benefit of worthless stock deduction . . (0.10) (0.59) — 0.49 (83.1)% (0.59) NM*

Core diluted EPS from continuing operations . . . $ 6.43 $ 5.92 $ 5.15 $ 0.51 8.6 % $ 0.77 15.0 %

* Not Meaningful

(1) Non-Core Adjustments are presented after-tax using the applicable effective tax rate for the respective periods.

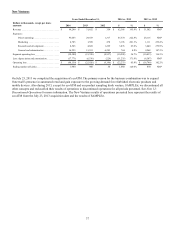

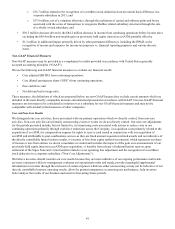

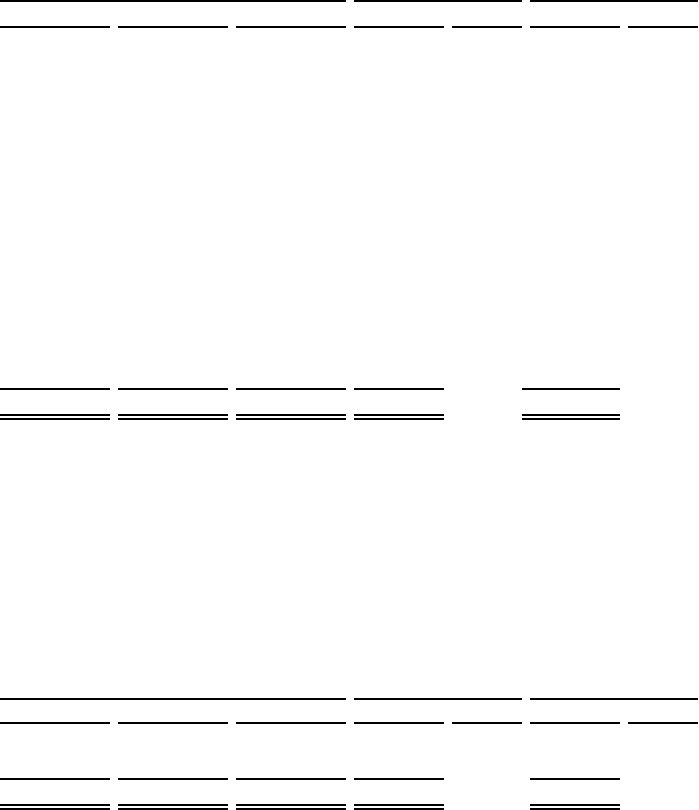

Free Cash Flow

Our non-GAAP financial measure free cash flow is defined as net cash provided by operating activities after capital

expenditures. We believe free cash flow is an important non-GAAP measure as it provides additional information to users of the

financial statements regarding our ability to service, incur or pay down indebtedness and repurchase our securities. A

reconciliation of free cash flow to net cash provided by operating activities, the most comparable GAAP financial measure, is

presented in the following table:

Years ended December 31, 2014 vs. 2013 2013 vs. 2012

Dollars in thousands 2014 2013 2012 $%$%

Net cash provided by operating activities . . . . . . $ 338,351 $ 327,834 $ 465,762 $ 10,517 3.2 % $ (137,928) (29.6)%

Purchase of property and equipment . . . . . . . . . . (97,924) (161,412) (209,910) 63,488 (39.3)% 48,498 (23.1)%

Free cash flow . . . . . . . . . . . . . . . . . . . . . . . $ 240,427 $ 166,422 $ 255,852 $ 74,005 44.5 % $ (89,430) (35.0)%

An analysis of our net cash from operating activities and used in investing and financing activities is provided below in the

Liquidity and Capital Resources section.