Redbox 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

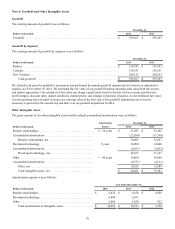

Goodwill

Goodwill represents the excess purchase price of an acquired enterprise or assets over the estimated fair value of identifiable net

assets acquired. We assess goodwill for potential impairment at the reporting unit level on an annual basis as of November 30,

or whenever an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit

below its carrying amount. We may assess qualitative factors to make this determination, or bypass such a qualitative

assessment and proceed directly to testing goodwill for impairment using a two-step process. Qualitative factors we may

consider include, but are not limited to, macroeconomic conditions, industry conditions, the competitive environment, changes

in the market for our products and services, regulatory and political developments and entity specific factors such as strategies

and financial performance. If, after completing such assessment, it is determined more likely than not that the fair value of a

reporting unit is less than its carrying value, we proceed to a two-step impairment test, whereby the first step is comparing the

fair value of a reporting unit with its carrying amount, including goodwill. If the fair value of a reporting unit exceeds its

carrying amount, goodwill of the reporting unit is considered not impaired and the second step of the test is not performed. The

second step of the impairment test is performed when the carrying amount of the reporting unit exceeds the fair value, then the

implied fair value of the reporting unit goodwill is compared with the carrying amount of that goodwill. If the carrying amount

of the reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment loss shall be recognized in an

amount equal to the excess. For additional information see Note 4: Goodwill and Other Intangible Assets.

Lives and Recoverability of Equipment and Other Long-Lived Assets

We evaluate the estimated remaining life and recoverability of equipment and other assets, including intangible assets subject to

amortization, whenever events or changes in circumstances indicate that the carrying amount of the asset may not be

recoverable. Factors that would indicate potential impairment include, but are not limited to, significant decreases in the market

value of the long-lived asset(s), a significant change in the long-lived asset’s use or physical condition, and operating or cash

flow losses associated with the use of the long-lived asset. When there is an indication of impairment, we prepare an estimate of

future undiscounted cash flows expected to result from the use of the asset and its eventual disposition to test recoverability. If

the sum of the future undiscounted cash flow is less than the carrying value of the asset, it indicates that the long-lived asset is

not recoverable, in which case we will then compare the estimated fair value to its carrying value. If the estimated fair value is

less than the carrying value of the asset, we recognize the impairment loss and adjust the carrying amount of the asset to its

estimated fair value.

During the fourth quarter of 2013, we discontinued three new venture concepts, RubiTM, Crisp MarketTM and Star StudioTM.

During the second quarter of 2013 we discontinued our OrangoTM concept. As a result of the decision to discontinue the four

concepts, for each concept we estimated the fair value of assets held utilizing a cash flow approach. For each of the concepts

and for certain shared service assets used for the new ventures, as of December 31, 2013, we estimated the fair value of the

assets was zero and recorded impairment charges for each concept. See Note 12: Discontinued Operations for additional

information.

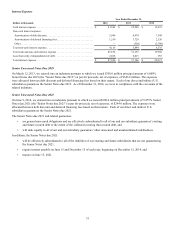

Income Taxes

Deferred income taxes are provided for the temporary differences between the financial reporting basis and the tax basis of our

assets and liabilities and operating loss and tax credit carryforwards. We record a valuation allowance to reduce deferred tax

assets to the amount expected to more likely than not be realized in our future tax returns. Deferred tax assets and liabilities and

operating loss and tax credit carryforwards are measured using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences and operating loss and tax credit carryforwards are expected to be recovered or

settled.

We assess our income tax positions and record tax benefits for all years subject to examination based upon management’s

evaluation of the facts, circumstances and information available at the reporting date. For those tax positions where it is more

likely than not that a tax benefit will be sustained, we have recorded the largest amount of tax benefit with a greater than 50%

likelihood of being realized upon ultimate or effective settlement with a taxing authority that has full knowledge of all relevant

information. In the event of a tax position where it would not be more likely than not that a tax benefit would be sustained, no

tax benefit would be recognized in the financial statements. When applicable, associated interest and penalties have been

recognized as a component of income tax expense. See Note 11: Income Taxes From Continuing Operations for additional

information.

Taxes Collected from Customers and Remitted to Governmental Authorities

We account for tax assessed by a governmental authority that is directly imposed on a revenue-producing transaction (i.e., sales,

value added) on a net (excluded from revenue) basis.