Redbox 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

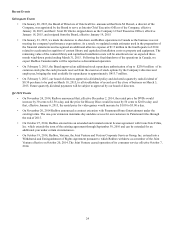

Q3 2014 Events

• On September 26, 2014, Universal Studios Home Entertainment LLC exercised its option to extend the term of the

revenue sharing license agreement between Redbox and Universal through December 31, 2015.

• On September 2, 2014, our remaining outstanding 4.0% Convertible Senior Notes ("Convertible Notes") matured. In

the three months ended September 30, 2014, we retired or settled upon maturity $33.4 million in face value of

Convertible Notes for $33.4 million in cash and the issuance of 248,944 shares of our common stock. See Note 7: Debt

and Other Long-Term Liabilities in our Notes to Consolidated Financial Statements for more information.

• During the three months ended September 30, 2014, we repurchased 1,185,970 shares of our common stock at an

average price of $59.52 per share for $70.6 million.(1)

Q2 2014 Events

• On June 27, 2014, Sony notified us of their intent to extend our existing content license agreement with them. This

extension will extend the license period through September 30, 2015.

• On June 24, 2014, we entered into a new credit facility arrangement consisting of a senior secured $600.0 million

revolving line of credit that, under certain conditions, may be increased up to an additional $200.0 million in

aggregate, and a senior secured $150.0 million amortizing term loan. The maturity of the credit facility is extended

until June 24, 2019.

• On June 9, 2014, we consummated a private offering to sell $300.0 million in aggregate principal amount of senior

unsecured notes due 2021. We used the proceeds to repay indebtedness under our prior credit facility and for general

corporate purposes.

• During the three months ended June, 30, 2014, we repurchased 711,556 shares of our common stock at an average

price of $70.27 per share for $50.0 million.(1)

Q1 2014 Events

• During January 2014, we repurchased 736,000 shares of our common stock at an average price of $67.93 per share for

$50.0 million.(1)

• During the three months ended March 31, 2014, we executed a tender offer in which we accepted for payment an

aggregate of 5,291,701 shares of our common stock at a final purchase price of $70.07 per share, for an aggregate cost

of $370.8 million, excluding fees and expenses.(1)

(1) Shares purchased as part of publicly announced repurchase plans or programs as approved by Board of Directors. See Note 8: Repurchases of

Common Stock in our Notes to Consolidated Financial Statements for more information.