Redbox 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

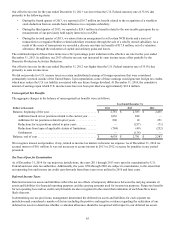

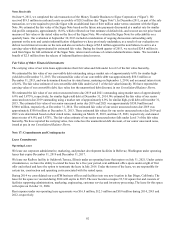

Our effective tax rate for the year ended December 31, 2013 was lower than the U.S. Federal statutory rate of 35.0% due

primarily to the following items:

• During the fourth quarter of 2013, we reported a $16.7 million tax benefit related to the recognition of a worthless

stock deduction from an outside basis difference in a corporate subsidiary.

• During the third quarter of 2013, we reported a $24.3 million tax benefit related to the non-taxable gain upon the re-

measurement of our previously held equity interest in ecoATM.

• During the second quarter of 2013, we entered into an arrangement to sell certain NCR kiosks and a series of

transactions to reorganize Redbox related subsidiary structures through the sale of a wholly owned subsidiary. As a

result of the series of transactions we recorded a discrete one-time tax benefit of $17.8 million, net of a valuation

allowance, through the realization of capital and ordinary gains and losses.

The combined impact of these three items was a 24.3 percentage point reduction in the effective tax rate for the year ended

December 31, 2013. In addition, our 2013 effective tax rate was increased by state income taxes, offset partially by the

Domestic Production Activities Deduction.

Our effective tax rate for the year ended December 31, 2012 was higher than the U.S. Federal statutory rate of 35.0% due

primarily to state income taxes.

We did not provide for U.S. income taxes on certain undistributed earnings of foreign operations that were considered

permanently invested outside of the United States. Upon repatriation, some of these earnings would generate foreign tax credits,

which may reduce the U.S. tax liability associated with any future foreign dividend. At December 31, 2014, the cumulative

amount of earnings upon which U.S. income taxes have not been provided was approximately $18.8 million.

Unrecognized Tax Benefits

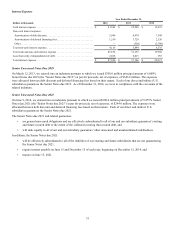

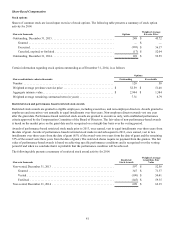

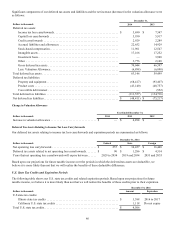

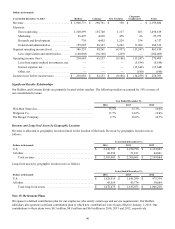

The aggregate changes in the balance of unrecognized tax benefits were as follows:

Dollars in thousands

Year Ended December 31,

2014 2013 2012

Balance, beginning of the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,781 $ 2,383 $ 2,455

Additions based on tax positions related to the current year. . . . . . 1,836 824 —

Additions for tax positions related to prior years . . . . . . . . . . . . . . 806 18 251

Reductions for tax positions related to prior years . . . . . . . . . . . . . — (257)(71)

Reductions from lapse of applicable statute of limitations . . . . . . . (784)(49)(252)

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (138)—

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,639 $ 2,781 $ 2,383

We recognize interest and penalties, if any, related to income tax matters in Income tax expense. As of December 31, 2014 we

accrued interest of $0.1 million. It was not necessary to accrue interest in 2013 or 2012 or accrue for penalties in any period

presented.

Tax Years Open for Examination

As of December 31, 2014 for our major tax jurisdictions, the years 2011 through 2013 were open for examination by U.S.

Federal and most state tax authorities. Additionally, the years 1998 through 2010 are subject to examination, to the extent that

net operating loss and income tax credit carryforwards from those years were utilized in 2010 and later years.

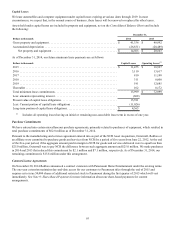

Deferred Income Taxes

Deferred income tax assets and liabilities reflect the net tax effects of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the carrying amounts used for income tax purposes. Future tax benefits

for net operating loss and tax credit carryforwards are also recognized to the extent that realization of such benefits is more

likely than not.

In determining our tax provisions, management determined the deferred tax assets and liabilities for each separate tax

jurisdiction and considered a number of factors including the positive and negative evidence regarding the realization of our

deferred tax assets to determine whether a valuation allowance should be recognized with respect to our deferred tax assets.