Pizza Hut 1999 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

A determination of the unrecognized deferred tax liability for

temporary differences related to our investments in foreign sub-

sidiaries and investments in foreign unconsolidated affiliates

that are essentially permanent in duration is not practicable.

We have available net operating loss and tax credit carryforwards

totaling $837 million at year-end 1999 to reduce future tax of

TRICON and certain subsidiaries. The carryforwards are related

to a number of foreign and state jurisdictions. Of these carryfor-

wards, $51 million expire in 2000 and $725 million expire

at various times between 2001 and 2019. The remain-

ing $61 million of carryforwards do not expire.

Reportable Operating Segments

We are engaged principally in developing, operat-

ing, franchising or licensing the worldwide KFC, Pizza

Hut and Taco Bell concepts. We also previously operated

the Non-core Businesses, all of which were sold in 1997 prior

to the Spin-off.

KFC, Pizza Hut and Taco Bell operate throughout the U.S. and

84, 87 and 14 countries and territories outside the U.S.,

respectively. Principal international markets include Australia,

Canada, China, Japan and the U.K. At year-end 1999, we had

10 investments in unconsolidated affiliates outside the U.S.

which operate KFC and/or Pizza Hut restaurants, the most sig-

nificant of which are operating in Japan and the U.K.

As disclosed in Note 2, we identify our operating segments

based on management responsibility within the U.S. and

International. For purposes of applying SFAS 131, we consider

our three U.S. Core Business operating segments to be similar

and therefore have aggregated them into a single reportable

operating segment. Other than the U.S., no individual country

represented 10% or more of our total revenues, profits or assets.

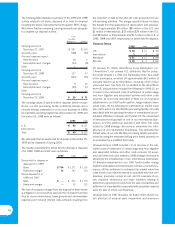

Revenues

1999 1998 1997

United States $ 5,748 $ 6,439 $ 7,370(a)

International 2,074 2,040 2,320

$ 7,822 $ 8,479 $ 9,690

Operating Profit; Interest Expense, Net;

and Income Before Income Taxes

1999 1998 1997

United States $ 828 $ 740 $ 603(a)

International(b) 265 191 172

Foreign exchange gain (loss) (3) 6 (16)

Unallocated and corporate

expenses (180) (169) (87)(c)

Facility actions net gain (loss)(d) 381 275 (247)

Unusual items(d) (51) (15) (184)

Total Operating Profit 1,240 1,028 241

Interest expense, net 202 272 276)

(c)

Income (loss) before

income taxes $ 1,038 $ 756 $ (35)

Depreciation and Amortization

1999 1998 1997

United States $ 266 $ 300 $ 388

International 110 104 143

Corporate 10 13 5

$ 386 $ 417 $ 536

Capital Spending

1999 1998 1997

United States $ 315 $ 305 $ 381

International 139 150 157

Corporate 16 53

$ 470 $ 460 $ 541

Identifiable Assets

1999 1998

United States $ 2,478 $ 2,942

International(e) 1,367 1,447

Corporate(f) 116 142

$ 3,961 $ 4,531

Long-Lived Assets

1999 1998

United States(g) $ 2,143 $ 2,616

International(g) 874 895

Corporate(g) 41 36

$ 3,058 $ 3,547

(a) Results from the United States in 1997 included the Non-core Businesses disposed of

in 1997. Excluding unusual disposal charges, the Non-core Businesses contributed the

following:

1997

Revenues $ 268

Operating profit 13

Interest expense, net 3

Income before income taxes 10

(b) Includes equity income of unconsolidated affiliates of $22 million, $18 million and

$8 million in 1999, 1998 and 1997, respectively.

(c) Includes amounts allocated by PepsiCo prior to the Spin-off of $37 million in 1997

related to general and administrative expenses and $188 million in 1997 related to

interest expense.

(d) See Note 5 for a discussion by reportable operating segment of facility actions net gain

(loss) and unusual items.

(e) Includes investment in unconsolidated affiliates of $170 million and $159 million for

1999 and 1998, respectively.

(f) Includes restricted cash, capitalized debt issuance costs, advances to our voluntary

employees’ beneficiary association trust, leasehold improvements in certain of our

office facilities and non-core assets held for sale.

(g) Includes PP&E, net and Intangible Assets, net.

See Note 5 for additional operating segment disclosures related

to impairment, suspension of depreciation and amortization

and the carrying amount of assets held for disposal.

note 20