Pizza Hut 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The 1999 ongoing effective tax rate decreased 3.0 points to

39.3%. The decrease in the ongoing effective tax rate was pri-

marily due to a one-time favorable international benefit in

Mexico. The recent pattern of profitability in Mexico and expec-

tations of future profitability have allowed us to reverse a

previous valuation allowance against deferred tax assets. This

will allow us to reduce future cash tax payments in Mexico.

The 1998 ongoing effective tax rate decreased 2.9 points to

42.3%. The decrease in the 1998 ongoing effective tax rate was

primarily due to favorable adjustments related to prior years.

The effective tax rate attributable to foreign operations varied

from year-to-year but in each year was higher than the

U.S. federal statutory tax rate. This was primarily due to foreign

tax rate differentials, including foreign withholding tax paid

without benefit of the related foreign tax credit for U.S. income

tax purposes and losses of foreign operations for which no tax

benefit could be currently recognized.

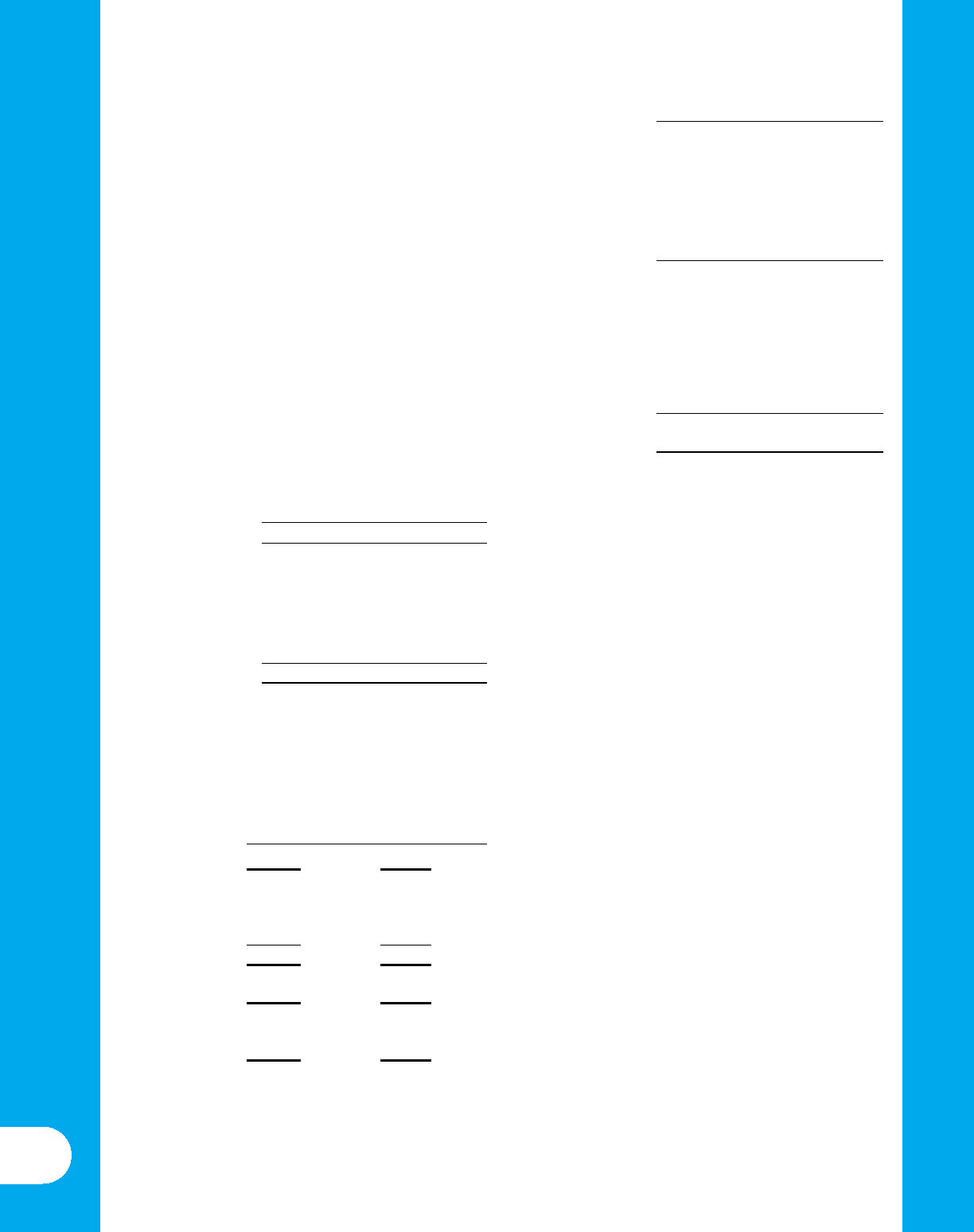

Diluted Earnings Per Share

The components of diluted earnings per common share

(“EPS”) were as follows:

Diluted(a) Basic Diluted(a) Basic

1999 1999 1998 1998

Ongoing operating

earnings $ 2.58 $ 2.69 $ 1.83 $ 1.88

Accounting changes 0.11 0.12 ——

Facility actions

net gain(b) 1.41 1.47 1.03 1.06

Unusual items(c) (0.18) (0.19) (0.02) (0.02)

Total $ 3.92 $ 4.09 $ 2.84 $ 2.92

(a) Based on 160 million shares in 1999 and 156 million shares in 1998 applicable to

diluted earnings. See Note 4.

(b) Includes favorable adjustments to our 1997 fourth quarter charge of $0.06 and $0.21

per diluted share in 1999 and 1998, respectively.

(c) Includes favorable adjustments to our 1997 fourth quarter charge of $0.07 and $0.04

per diluted share in 1999 and 1998, respectively.

U.S. Results of Operations

% B(W) % B(W)

1999 vs. 1998 1998 vs. 1997

System Sales $ 14,516 4 $ 14,013 4

Revenues

Company sales $ 5,253 (13) $ 6,013 (14)

Franchise and

license fees(1) 495 16 426 13

Total Revenues $ 5,748 (11) $ 6,439 (13)

Company

Restaurant Margin $ 825 1 $ 819 —

% of sales 15.7% 2.1 ppts)

.13.6% 1.9 ppts)

.

Ongoing

Operating Profit(2) $ 813 10 $ 740 23

(1) Excluding the special 1997 KFC renewal fees, 1998 increased 21% over 1997.

(2) Excludes 1999 accounting changes, facility actions net gain (loss) and unusual items.

U.S. Restaurant Unit Activity

Company Franchisees Licensees Total

Balance at

Dec. 27, 1997(a) 7,794 9,512 3,167 20,473

New Builds &

Acquisitions 75 338 508 921

Refranchising &

Licensing (1,219) 1,216 3 —

Closures (418) (204) (403) (1,025)

Balance at

Dec. 26, 1998 6,232 10,862 3,275 20,369

New Builds &

Acquisitions 155 432 539 1,126

Refranchising &

Licensing (1,170) 1,167 3 —

Closures (230) (248) (593) (1,071)

Other (3) (103) (124) (230)

Balance at

Dec. 25, 1999 4,984(b) 12,110 3,100 20,194

% of total 24.7% 60.0% 15.3% 100.0%

(a) A total of 114 units have been reclassified from the U.S. to International to reflect the

transfer of management responsibility.

(b) Includes 36 Company units approved for closure, but not yet closed at December 25,

1999.

U.S. System Sales and Revenues

System sales increased $503 million or 4% in 1999. The

improvement was driven by new unit development, led by Taco

Bell franchisees and same store sales growth at our three

U.S. concepts. These increases were partially offset by store

closures, primarily at Pizza Hut and Taco Bell.

In 1998, system sales increased $511 million or 4%. The

increase was attributable to new unit development, primarily

by franchisees and licensees of Taco Bell and, to a lesser

extent, KFC, and positive same store sales growth at all three

of our concepts. These increases were partially offset by the

impact of store closures.

Revenues decreased $691 million or 11% due to the

expected decline in Company sales of $760 million or 13% in

1999. The decline in Company sales was due to the portfolio

effect. Excluding the portfolio effect, Company sales increased

approximately $305 million or 6%. This increase was primarily

due to new unit development, favorable effective net pricing

and volume increases led by Pizza Hut’s first quarter new prod-

uct introduction, “The Big New Yorker.” Franchise and license

fees increased $69 million or 16% in 1999. The increase was

driven by units acquired from us, new unit development and

franchisee same store sales growth, primarily at Pizza Hut.

These increases were partially offset by store closures.

We measure same store sales only for our U.S. Company

restaurants. Same store sales at Pizza Hut increased 9% in

1999. The improvement was primarily driven by an increase in

30