Pizza Hut 1999 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

(2) reduction to fair market value, less costs to sell, of the car-

rying amounts of certain restaurants we intended to

refranchise; (3) impairment of certain restaurants intended to

be used in the business; (4) impairment of certain investments

in unconsolidated affiliates to be retained; and (5) costs of

related personnel reductions. Of the $530 million charge,

approximately $401 million related to asset writedowns and

approximately $129 million related to liabilities, primarily

occupancy-related costs and, to a much lesser extent, sever-

ance. The liabilities were expected to be settled from cash flows

provided by operations. Through December 25, 1999, the

amounts used apply only to the actions covered by the charge.

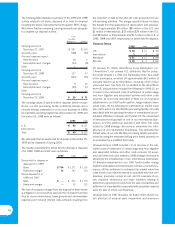

The components of the 1997 fourth quarter charge are detailed

below:

U.S. International Worldwide

Store closure costs $ 141 $ 72 $ 213

Refranchising losses 77 59 136

Impairment charges 12 49 61

Total facility actions net loss 230 180 410

Impairment of investments in

unconsolidated affiliates — 79 79

Severance and other 18 23 41

Total unusual items 18 102 120

Total fourth quarter charges $ 248 $ 282 $ 530

Total fourth quarter charges,

after-tax $ 176 $ 249 $ 425

During 1999 and 1998, we continued to re-evaluate our prior

estimates of the fair market value of units to be refranchised or

closed and other liabilities arising from the charge. In 1999, we

recorded favorable adjustments of $13 million ($10 million

after-tax) and $11 million ($10 million after-tax) included in

facility actions net gain and unusual items, respectively. These

adjustments relate to lower-than-expected losses from stores

disposed of, decisions to retain stores originally expected to be

disposed of and changes in estimated costs. In 1998, favor-

able adjustments of $54 million ($33 million after-tax) and

$11 million ($7 million after-tax) were included in facility

actions net gain and unusual items, respectively. These adjust-

ments primarily related to decisions to retain certain stores

originally expected to be disposed of, lower-than-expected

losses from stores disposed of and favorable lease settlements

with certain lessors related to stores closed.

Our operating profit includes benefits from the suspension of

depreciation and amortization of approximately $12 million

($7 million after-tax) and $33 million ($21 million after-tax)

in 1999 and 1998, respectively, for stores held for disposal.

The relatively short-term benefits from depreciation and amor-

tization suspension related to stores that were operating at the

end of the respective periods ceased when the stores were

refranchised, closed or a subsequent decision was made to

retain the stores.

Although we originally expected to refranchise or close all

1,392 units included in the original charge by year-end 1998,

the disposal of 531 units was delayed. In 1999, we disposed of

326 units, and decisions were made to retain 195 units origi-

nally expected to be disposed of in 1999.

Below is a summary of activity through 1999 related to the units

covered by the 1997 fourth quarter charge:

Units Expected to be Total Units

Closed Refranchised Remaining

Units at December 27, 1997 740 652 1,392

Units disposed of (426) (320) (746)

Units retained (88) (20) (108)

Change in method of disposal (109) 109 —

Other 6 (13) (7)

Units at December 26, 1998 123 408 531

Units disposed of (79) (247) (326)

Units retained (29) (166) (195)

Change in method of disposal (21) 21 —

Other 6 (16) (10)

Units at December 25, 1999 ———

Below is a summary of the 1999 and 1998 activity related to

our asset valuation allowances and liabilities recognized as a

result of the 1997 fourth quarter charge:

Asset

Valuation

Allowances Liabilities Total

Balance at

December 27, 1997 $ 261 $ 129 $ 390

Amounts used (131) (54) (185)

(Income) expense impacts:

Completed transactions (27) (7) (34)

Decision changes (22) (17) (39)

Estimate changes 15 (7) 8

Other 1 — 1

Balance at

December 26, 1998 $ 97 $ 44 $ 141

Amounts used (87) (32) (119)

(Income) expense impacts:

Completed transactions (5) — (5)

Decision changes 1 (3) (2)

Estimate changes (7) (9) (16)

Other 1 — 1

Balance at

December 25, 1999 $— $— $—