Pizza Hut 1999 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

$2.5 million, respectively. The effects of a one percentage

point increase or decrease in the assumed health care cost

trend rates on total service and interest cost components are

not significant.

At the end of 1998, we changed the method for determining

our pension and postretirement medical benefit discount rate

to better reflect the assumed investment strategies we

would most likely use to invest any short-term cash

surpluses. See Note 5.

Employee Stock-Based Compensation

At year-end 1999, we had four stock option plans

in effect: the TRICON Global Restaurants, Inc. Long-

Term Incentive Plan (“1999 LTIP”), the 1997 Long-Term

Incentive Plan (“1997 LTIP”), the TRICON Global Restaurants,

Inc. Restaurant General Manager Stock Option Plan (“YUM-

BUCKS”) and the TRICON Global Restaurants, Inc.

SharePower Plan (“SharePower”).

We may grant options to purchase up to 7.6 million and 22.5

million shares of stock under the 1999 LTIP and 1997 LTIP,

respectively, at a price equal to or greater than the average mar-

ket price of the stock on the date of grant. New options we

grant can have varying vesting provisions and exercise periods.

Previously granted options vest in periods ranging from imme-

diate to 2006 and expire ten to fourteen years after grant.

Potential awards to employees and non-employee directors

under the 1999 LTIP include stock options, incentive stock

options, stock appreciation rights, restricted stock, stock units,

restricted stock units, performance shares and performance

units. Potential awards to employees and non-employee direc-

tors under the 1997 LTIP include stock options, incentive stock

options, stock appreciation rights, restricted stock and per-

formance restricted stock units. We have issued only stock

options and performance restricted stock units under the 1997

LTIP and have yet to grant any awards under the 1999 LTIP.

We may grant options to purchase up to 7.5 million shares of

stock under YUMBUCKS at a price equal to or greater than the

average market price of the stock on the date of grant. YUM-

BUCKS options granted have a four year vesting period and

expire ten years after grant. We do not anticipate that any

further SharePower grants will be made although options

previously granted could be outstanding through 2006.

At the Spin-off Date, we converted certain of the unvested

options to purchase PepsiCo stock that were held by our

employees to TRICON stock options under either the 1997

LTIP or the SharePower. We converted the options at amounts

and exercise prices that maintained the amount of unrealized

stock appreciation that existed immediately prior to the Spin-

off. The vesting dates and exercise periods of the options were

not affected by the conversion. Based on their original PepsiCo

grant date, our converted options vest in periods ranging from

one to ten years and expire ten to fifteen years after grant.

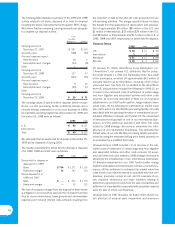

Had we determined compensation cost for all TRICON option

grants to employees and non-employee directors consistent

with SFAS 123, our net income (loss) and basic and diluted

earnings per Common Share would have been reduced

(increased) to the pro forma amounts indicated below:

1999 1998 1997

Net Income (Loss)

As reported $ 627 $ 445 $ (111)

Pro forma 597 425 (112)

Basic Earnings

per Common Share

As reported $ 4.09 $ 2.92

Pro forma 3.90 2.79

Diluted Earnings

per Common Share

As reported $ 3.92 $ 2.84

Pro forma 3.73 2.72

SFAS 123 pro forma loss per Common Share data for 1997 is

not meaningful as we were not an independent, publicly owned

company with a capital structure of our own for the entire year.

The effects of applying SFAS 123 in the pro forma disclosures

are not likely to be representative of the effects on pro forma net

income for future years because variables such as the number

of option grants, exercises and stock price volatility included in

these disclosures may not be indicative of future activity.

We estimated the fair value of each option grant made during

1999, 1998 and 1997 subsequent to the Spin-off as of the date

of grant using the Black-Scholes option pricing model with the

following weighted average assumptions:

1999 1998 1997

Risk-free interest rate 4.9% 5.5% 5.8%

Expected life (years) 6.0 6.0 6.6

Expected volatility 29.7% 28.8% 27.5%

Expected dividend yield 0.0% 0.0% 0.0%

note 15