Pizza Hut 1999 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

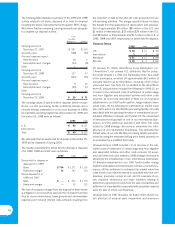

Comprehensive Income

Accumulated Other Comprehensive Income

includes:

1999 1998 1997

Foreign currency translation

adjustment arising

during the period $15 $ (21) $ (90)

Less:

Foreign currency translation

adjustment included

in net income (loss) —1 (11)

Net foreign currency

translation adjustment $15 $ (20) $ (101)

Accumulated Other Comprehensive Income consisted of the

following components as of December 25, 1999 and

December 26, 1998:

1999 1998

Foreign currency translation

adjustment $ (133) $ (148)

Minimum pension

liability adjustment —(2)

Total accumulated other

comprehensive income $ (133) $ (150)

Earnings Per Common Share (“EPS”)

1999 1998

Net income $ 627 $ 445

Basic EPS:

Weighted-average common

shares outstanding 153 153

Basic EPS $ 4.09 $ 2.92

Diluted EPS:

Weighted-average common

shares outstanding 153 153

Shares assumed issued on

exercise of dilutive

share equivalents 24 20

Shares assumed purchased

with proceeds of dilutive

share equivalents (17) (17)

Shares applicable to

diluted earnings 160 156

Diluted EPS $ 3.92 $ 2.84

Unexercised employee stock options to purchase approxi-

mately 2.5 million and 1 million shares of our Common Stock

for the years ended December 25, 1999 and December 26,

1998, respectively, were not included in the computation of

diluted EPS because their exercise prices were greater than the

average market price of our Common Stock during the year.

We have omitted EPS data for the year ended December 27,

1997 since we were not an independent, publicly

owned company with a capital structure of our own

for the entire year.

Items Affecting Comparability of Net

Income (Loss)

Accounting Changes. In 1998 and 1999, we

adopted several accounting and human resource policy

changes (collectively, the “accounting changes”) that impacted

our 1999 operating profit. These changes, which we believe

are material in the aggregate, fall into three categories:

• required changes in Generally Accepted Accounting

Principles (“GAAP”),

• discretionary methodology changes implemented to more

accurately measure certain liabilities and

• policy changes driven by our human resource and accounting

standardization programs.

Required Changes in GAAP. Effective December 27,

1998, we adopted Statement of Position 98-1 (“SOP 98-1”),

“Accounting for the Costs of Computer Software Developed or

Obtained for Internal Use.” SOP 98-1 identifies the character-

istics of internal-use software and specifies that once the

preliminary project stage is complete, direct external costs, cer-

tain direct internal payroll and payroll-related costs and interest

costs incurred during the development of computer software

for internal use should be capitalized and amortized.

Previously, we expensed all software development and pro-

curement costs as incurred. In 1999, we capitalized

approximately $13 million of internal software development

costs and third party software costs that we would have previ-

ously expensed. As of December 25, 1999, no interest costs

were capitalized due to the insignificance of amounts. The

majority of the software being developed is not yet ready for its

intended use. The amortization of assets that became ready for

their intended use in 1999 was immaterial.

In addition, we adopted Emerging Issues Task Force Issue

No. 97-11 (“EITF 97-11”), “Accounting for Internal Costs

Relating to Real Estate Property Acquisitions,” upon its

issuance in March 1998. EITF 97-11 limits the capitalization

of internal real estate acquisition costs to those site-specific

costs incurred subsequent to the time that the real estate

note 4

note 5

note 3