Pizza Hut 1999 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

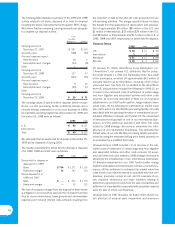

55

The assumptions used to compute the information above are

set forth below:

Postretirement

Pension Benefits Medical Benefits

1999 1998 1999 1998

Discount rate —

projected benefit

obligation 7.8% 6.8% 7.6% 7.0%

Expected long-term

rate of return on

plan assets 10.0% 10.0% ——

Rate of compensation

increase 5.5% 4.5% 5.5% 4.5%

We have assumed the annual increase in cost of postretirement

medical benefits was 6.5% in 1999 and will be 6.0% in 2000.

We are assuming the rate will decrease 0.5% to an ultimate

rate of 5.5% in the year 2001 and remain at that level there-

after. There is a cap on our medical liability for certain retirees,

which is expected to be reached between the years 2001–

2004; at that point our cost for a retiree will not increase.

Assumed health care cost trend rates have a significant effect

on the amounts reported for our postretirement health care

plans. The effects of a one percentage point increase or

decrease in the assumed health care cost trend rates on

post-retirement benefit obligations are $2.3 million and

Postretirement

Pension Benefits Medical Benefits

1999 1998 1999 1998

Change in benefit obligation

Benefit obligation at beginning of year $ 315 $ 286 $38 $38

Service cost 20 21 22

Interest cost 22 20 33

Plan amendments 6———

Curtailment gain (5) —(1) (3)

Special termination benefits —1—1

Benefits and expenses paid (24) (13) (2) (2)

Actuarial (gain) loss (19) —5(1)

Benefit obligation at end of year 315 315 45 38

Change in plan assets

Fair value of plan assets at beginning of year 259 270 ——

Actual return on plan assets 51 1——

Employer contributions 51——

Benefits paid (23) (11) ——

Administrative expenses (2) (2) ——

Fair value of plan assets at end of year 290 259 ——

Reconciliation of funded status

Funded status (25) (56) (45) (38)

Unrecognized actuarial (gain) loss (35) 11 3(2)

Unrecognized prior service costs 72(2) (4)

Net amount recognized at year-end $ (53) $ (43) $ (44) $ (44)

Amounts recognized in the statement of financial position consist of:

Accrued benefit liability $ (53) $ (46) $ (44) $ (44)

Accumulated other comprehensive income —3——

Net amount recognized at year-end $ (53) $ (43) $ (44) $ (44)

Other comprehensive income attributable to change

in additional minimum liability recognition $ (3) $3

Additional year-end information for pension plans

with benefit obligations in excess of plan assets:

Benefit obligation $ 315 $ 315

Fair value of plan assets 290 259

Additional year-end information for pension plans with

accumulated benefit obligations in excess of plan assets:

Projected benefit obligation $31 $46

Accumulated benefit obligation 12 29

Fair value of plan assets —15