Pizza Hut 1999 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

unfavorably impacted ongoing operating profit. This increase

in G&A was largely due to the biennial conferences at Pizza

Hut and Taco Bell to support our corporate culture initiatives.

In 1998, ongoing operating profit increased approximately

$137 million or 23%. Excluding the effect of our Non-core

Businesses, our ongoing operating profit increased approxi-

mately $150 million or 26%. The increase was due to our base

restaurant margin improvement of 80 basis points and reduced

G&A expenses. Higher franchise and license fees were partially

offset by the absence of the special 1997 KFC renewal fees.

The impact due to the portfolio effect was insignificant. Ongoing

operating profit included the benefits of our 1997 fourth quar-

ter charge of approximately $35 million, of which $19 million

related to the suspension of depreciation and amortization for

stores included in the charge.

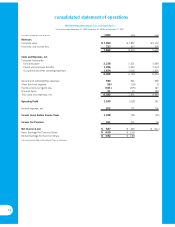

International Results of Operations

1999 1998

% B(W) % B(W)

Amount vs. 1998 Amount vs. 1997

System Sales $ 7,246 10 $ 6,607 (5)

Revenues

Company sales $ 1,846 — $ 1,839 (13)

Franchise and

license fees 228 13 201 —

Total Revenues $ 2,074 2 $ 2,040 (12)

Company

Restaurant Margin $ 266 11 $ 239 (1)

% of sales 14.4% 1.4 ppts)

.13.0% 1.6 ppts)

.

Ongoing

Operating Profit(1) $ 265 39 $ 191 11

(1) Excludes 1999 accounting changes, facility actions net gain (loss) and unusual items.

32

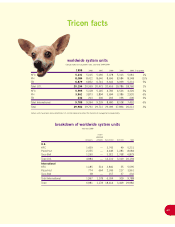

International Restaurant Unit Activity

Unconsolidated

Company Affiliates Franchisees Licensees Total

Balance at Dec. 27, 1997(a) 2,323 1,090 5,585 241 9,239

New Builds & Acquisitions 150 63 452 36 701

Refranchising & Licensing (154) (9) 86 77 —

Closures (154) (24) (335) (33) (546)

Balance at Dec. 26, 1998 2,165 1,120 5,788 321 9,394

New Builds & Acquisitions 168 83 426 47 724

Refranchising & Licensing (265) (5) 276 (6) —

Closures (71) (20) (186) (53) (330)

Balance at Dec. 25, 1999 1,997(b) 1,178 6,304 309 9,788

% of Total 20.4% 12.0% 64.4% 3.2% 100.0%

(a) A total of 114 units have been reclassified from the U.S. to International to reflect the transfer of management responsibility.

(b) Includes 1 Company unit approved for closure, but not yet closed at December 25, 1999.

International System Sales and Revenues

System Sales increased $639 million or 10% in 1999 largely

driven by our strong performance in Asia. Excluding the favor-

able impact from foreign currency translation, system sales

increased $498 million or 8%. This was led by Asia, our largest

region. System sales in Asia increased $426 million or 19%.

Excluding the favorable impact of foreign currency translation,

system sales in Asia increased $229 million or 10%. In 1999,

the economy in Asia began to show signs of a steady recovery

after the overall economic turmoil and weakening of local cur-

rencies against the U.S. dollar that began in late 1997. The

increase in system sales in Asia was driven by new unit devel-

opment and same store sales growth. Outside of Asia, the

improvement was driven by new unit development, both by

franchisees and us, and same store sales growth. New unit

development was primarily in Mexico and the U.K. The

increase in system sales was partially offset by store closures

primarily by franchisees in Canada, Latin America and Japan.

In 1998, system sales decreased $356 million or 5%. Exclu-

ding the negative impact of foreign currency translation, system

sales increased $360 million or 5%. The increase was driven

by new unit development, primarily in Asia, partially offset by

store closures in other countries/markets. System sales in Asia

decreased $254 million or 10% as a result of the economic tur-

moil. Excluding the unfavorable impact of foreign currency

translation, system sales in Asia increased 8%.

Revenues increased $34 million or 2% in 1999. Excluding the

favorable impact of foreign currency translation, revenues

increased $29 million or 1%. Company sales increased less than

1% in 1999. New unit development, favorable effective net pric-

ing and volume increases were largely offset by the portfolio

effect. Excluding the portfolio effect, Company sales increased

$208 million or 13% in 1999 largely driven by our strong per-

formance in Asia. Revenues in Asia increased $139 million or

28%. Excluding the favorable impact of foreign currency trans-

lation, revenues in Asia increased $115 million or 23% driven

by new unit development and same store sales growth.