Pizza Hut 1999 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

reflect the recognized foreign currency differential not yet set-

tled in cash on the accompanying Consolidated Balance Sheet

each period as a current receivable or payable. If a foreign cur-

rency forward contract was to be terminated prior to maturity,

the gain or loss recognized upon termination would be imme-

diately recognized into income.

We defer gains and losses on futures contracts that are des-

ignated and effective as hedges of future commodity

purchases and include them in the cost of the related raw

materials when purchased. Changes in the value of futures

contracts that we use to hedge commodity purchases are

highly correlated to the changes in the value of the purchased

commodity. If the degree of correlation between the futures

contracts and the purchase contracts were to diminish such

that the two were no longer considered highly correlated, we

would recognize in income subsequent changes in the value

of the futures contracts.

Cash and Cash Equivalents. Cash equivalents represent

funds we have temporarily invested (with original maturities not

exceeding three months) as part of managing our day-to-day

operating cash receipts and disbursements.

Inventories. We value our inventories at the lower of cost

(computed on the first-in, first-out method) or net realizable

value.

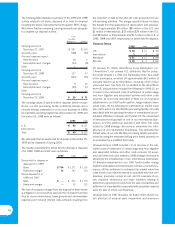

Property, Plant and Equipment. We state property, plant

and equipment (“PP&E”) at cost less accumulated deprecia-

tion and amortization, impairment writedowns and valuation

allowances. We calculate depreciation and amortization on a

straight-line basis over the estimated useful lives of the assets

as follows: 5 to 25 years for buildings and improvements,

3 to 20 years for machinery and equipment and 3 to 7 years for

capitalized software costs. We suspend depreciation and amor-

tization on assets related to restaurants that are held for

disposal. Our depreciation and amortization expense was

$345 million, $372 million and $460 million in 1999, 1998 and

1997, respectively.

Intangible Assets. Intangible assets include both identifi-

able intangibles and goodwill arising from the allocation of

purchase prices of businesses acquired. Where appropriate,

the intangibles are allocated to the individual store level at the

time of acquisition. We base amounts assigned to identifiable

intangibles on independent appraisals or internal estimates.

Goodwill represents the residual purchase price after alloca-

tion to all identifiable net assets. Our intangible assets are

stated at historical allocated cost less accumulated amortiza-

tion, impairment writedowns and valuation allowances. We

amortize intangible assets on a straight-line basis as follows:

up to 20 years for reacquired franchise rights, 3 to 34 years for

trademarks and other identifiable intangibles and up to

20 years for goodwill. As discussed further below, we suspend

amortization on intangible assets allocated to restaurants

that are held for disposal. Our amortization expense was

$44 million, $52 million and $70 million in 1999, 1998 and

1997, respectively.

Franchise and License Fees. We execute franchise or

license agreements covering each point of distribution which

provide the terms of our arrangement with the franchisee or

licensee. Our franchise and certain license agreements gener-

ally require the franchisee or licensee to pay an initial,

non-refundable fee. Our agreements also require continuing

fees based upon a percentage of sales. Subject to our approval

and payment of a renewal fee, a franchisee may generally

renew its agreement upon its expiration. Our direct costs of the

sales and servicing of franchise and license agreements are

charged to general and administrative expense as incurred.

We recognize initial fees as revenue when we have performed

substantially all initial services required by the franchising

or licensing agreement, which is generally upon opening

of a store. We recognize continuing fees as earned with

an appropriate provision for estimated uncollectible amounts.

We recognize renewal fees in earnings when a renewal

agreement becomes effective. We include initial fees collected

upon the sale of a restaurant to a franchisee in refranchising

gains (losses).

Refranchising Gains (Losses). Refranchising gains

(losses) include the gains or losses from the sales of our restau-

rants to new and existing franchisees and the related initial

franchise fees reduced by direct administrative costs of refran-

chising. We recognize gains on restaurant refranchisings when

the sale transaction closes, the franchisee has a minimum

amount of the purchase price in at-risk equity and we are sat-

isfied that the franchisee can meet its financial obligations.

Otherwise, we defer refranchising gains until those criteria have

been met. In executing our refranchising initiatives, we most

often offer groups of restaurants. We only consider the stores

in the group “held for disposal” where the group is expected to

be sold at a loss. We recognize estimated losses on restaurants

to be refranchised and suspend depreciation and amortization

when: (1) we make a decision to refranchise stores; (2) the esti-

mated fair value less costs to sell is less than the carrying

amount of the stores; and (3) the stores can be immediately

removed from operations. For groups of restaurants expected

to be sold at a gain, we typically do not suspend depreciation

and amortization until the sale is probable. For practical pur-

poses, we treat the closing date as the point at which the sale

is probable. When we make a decision to retain a store previ-

ously held for refranchising, we revalue the store at the lower

of its net book value at our original disposal decision date less

normal depreciation during the period held for disposal or its