Pizza Hut 1999 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

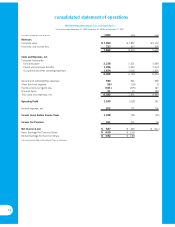

consolidated statement of cash flows

TRICON Global Restaurants, Inc. and Subsidiaries

Fiscal years ended December 25, 1999, December 26, 1998 and December 27, 1997

(in millions) 1999 1998 1997

Cash Flows — Operating Activities

Net income (loss) $ 627 $ 445 $ (111)

Adjustments to reconcile net income (loss) to

net cash provided by operating activities:

Depreciation and amortization 386 417 536

Facility actions net (gain) loss (381) (275) 247

Unusual items 45 15 184

Other liabilities and deferred credits 65 58 —

Deferred income taxes (16) 3 (138)

Other non-cash charges and credits, net 66 117 65

Changes in operating working capital,

excluding effects of acquisitions and dispositions:

Accounts and notes receivable (28) (8) (22)

Inventories 643

Prepaid expenses and other current assets (13) (20) —

Accounts payable and other current liabilities (215) 10 3

Income taxes payable 23 (92) 43

Net change in operating working capital (227) (106) 27

Net Cash Provided by Operating Activities 565 674 810

Cash Flows — Investing Activities

Capital spending (470) (460) (541)

Refranchising of restaurants 916 784 770

Acquisition of restaurants (6) ——

Sales of Non-core Businesses —— 186

Sales of property, plant and equipment 51 58 40

Other, net 31 (80) 11

Net Cash Provided by Investing Activities 522 302 466

Cash Flows — Financing Activities

Proceeds from Notes —604 —

Revolving Credit Facility activity, by original maturity

More than three months — proceeds —400 500

More than three months — payments —(900) —

Three months or less, net (860) (120) 1,935

Proceeds from long-term debt 44 2,000

Payments of long-term debt (180) (1,068) (65)

Short-term borrowings — three months or less, net 21 (53) 83

Decrease in investments by and advances from PepsiCo —— (3,281)

Dividend to PepsiCo —— (2,369)

Repurchase shares of common stock (134) ——

Other, net 30 13 59

Net Cash Used for Financing Activities (1,119) (1,120) (1,138)

Effect of Exchange Rate Changes on Cash and Cash Equivalents —(3) (7)

Net (Decrease) Increase in Cash and Cash Equivalents (32) (147) 131

Cash and Cash Equivalents — Beginning of Year 121 268 137

Cash and Cash Equivalents — End of Year $89 $ 121 $ 268

Supplemental Cash Flow Information

Interest paid $ 212 $ 303 $ 64

Income taxes paid 340 310 210

See accompanying Notes to Consolidated Financial Statements.