Pizza Hut 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Worldwide General & Administrative Expenses

(“G&A”)

G&A decreased $21 million or 2% in 1999. Excluding the

$18 million favorable impact of 1999 accounting changes,

G&A decreased $3 million in 1999. In 1999, the favorable

impacts of our portfolio effect, our fourth quarter 1998 deci-

sion to streamline our international business and the absence

of costs associated with relocating certain operations from

Wichita, Kansas in 1998 were partially offset by higher strate-

gic and other corporate expenses. In addition to the items

described above, higher spending on biennial meetings to

support our culture initiatives and the absence of favorable

cost recovery agreements with AmeriServe Food Distribution,

Inc. (“AmeriServe”) and PepsiCo that were terminated in 1998

resulted in a modest increase in G&A in 1999. Our 1999 G&A

included Year 2000 spending of approximately $30 million as

compared to $31 million in 1998.

In 1998, G&A decreased $15 million or 2%. G&A in 1997

included approximately $24 million related to Non-core

Businesses. Excluding the impact of the Non-core Businesses,

G&A increased $9 million or 1%. The increase reflected higher

investment spending offset by the favorable impacts of our

portfolio effect, decreased restaurant support center and field

operating overhead and foreign currency translation. Our

investment spending consisted primarily of costs related to

Year 2000 compliance and remediation efforts of $31 million in

1998 versus $4 million in 1997, along with the costs to relo-

cate our processing center from Wichita to other existing

restaurant support centers of $14 million. In addition, we expe-

rienced increased administrative expenses as an independent,

publicly owned company and incurred additional expenses

related to continuing efforts to improve and standardize admin-

istrative and accounting systems.

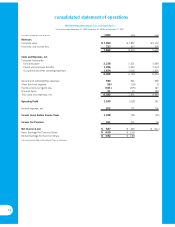

Worldwide Other (Income) Expense

% B(W) % B(W)

1999 vs. 1998 1998 vs. 1997

Equity income from

investments in

unconsolidated

affiliates $ (19) 6 $ (18) NM

Foreign exchange

net loss (gain) 3NM (6) NM

$ (16) (31) $ (24) NM

Other income declined $8 million in 1999. Net foreign

exchange losses were $3 million in 1999 compared to net

foreign exchange gains of $6 million in 1998. This decline was

due to foreign losses in 1999 versus gains in 1998 related to

U.S. dollar denominated short-term investments in Canada.

In 1998, equity income from investments in our unconsoli-

dated affiliates increased $10 million. This increase was due

primarily to lower amortization relating to the impact of the

$79 million joint venture investment impairment included in

our 1997 fourth quarter charge and, to a lesser extent, the

impact of new unit development primarily by our affiliate in the

United Kingdom. Net foreign exchange gains were $6 million

in 1998 compared to net foreign exchange losses of $16 mil-

lion in 1997. This improvement was due primarily to

non-recurring 1997 foreign exchange losses, predominantly

in Thailand and the Netherlands, and to foreign exchange

gains in 1998 primarily due to U.S. dollar denominated short-

term investments in Canada.

28

Worldwide Facility Actions Net (Gain) Loss

1999 1998 1997

Excluding Excluding

1997 4th Qtr. 1997 4th Qtr. Excluding

Charge Charge 4th Qtr.

Total Adjustments Total Adjustments Total Charge

Refranchising net gains $ (422) $ (418) $ (279) $ (281) $ (112) $ (248)

Store closure net costs 13 22 (27) 29 248 35

Impairment charges for stores that

will continue to be used in the business 16 16 25 25 111 50

Impairment charges for stores

to be closed in the future 12 12 66——

Facility actions net (gain) loss $ (381) $ (368) $ (275) $ (221) $ 247 $ (163)

Refranchising net gains resulted from the refranchising of

1,435 units in 1999, 1,373 units in 1998 and 1,407 units in

1997. These gains included initial franchise fees of $45 million,

$44 million and $41 million in 1999, 1998 and 1997, respec-

tively. See pages 25 – 26 for more details regarding our

refranchising activities.

Impairment charges for stores that will continue to be used in

the business were $16 million in 1999 compared to $25 mil-

lion in 1998 reflecting fewer underperforming stores. In 1998,

upon adoption of the SEC’s interpretation of SFAS 121, we also

began to perform impairment evaluations when we expect to

actually close a store beyond the quarter in which our closure

decision is made. This change resulted in additional impair-

ment charges of $12 million in 1999 and $6 million in 1998.

Under our prior accounting policy, these impairment charges

would have been included in store closure costs. We believe

the overall decrease in impairment in 1998 was significantly

impacted by 1997 decisions included in our fourth quarter