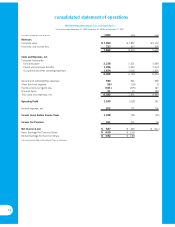

Pizza Hut 1999 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

acquisition is probable. We consider acquisition of the property

probable upon final site approval. In the first quarter of 1999,

we also made a discretionary policy change limiting the types

of costs eligible for capitalization to those direct cost types

described as capitalizable under SOP 98-1. Prior to the adop-

tion of EITF 97-11, all pre-acquisition real estate activities were

considered capitalizable. This change unfavorably impacted

our 1999 operating profit by approximately $3 million.

To conform to the Securities and Exchange Commission’s

April 23, 1998 letter interpretation of Statement of Financial

Accounting Standards No. 121, “Accounting for the

Impairment of Long-Lived Assets and for Long-Lived Assets to

Be Disposed Of,” our store closure accounting policy was

changed in 1998. Effective for closure decisions made on or

subsequent to April 23, 1998, we recognize store closure costs

when we have closed the restaurant within the same quarter

the closure decision is made. When we decide to close a

restaurant beyond the quarter in which the closure decision is

made, it is reviewed for impairment. The impairment evaluation

is based on the estimated cash flows from continuing use until

the expected date of disposal plus the expected terminal value.

If the restaurant is not fully impaired, we continue to depreci-

ate the assets over their estimated remaining useful life. Prior

to April 23, 1998, we recognized store closure costs and gen-

erally suspended depreciation and amortization when we

decided to close a restaurant within the next twelve months.

This change resulted in additional depreciation and amortization

of approximately $3 million through April 23, 1999.

Discretionary Methodology Changes. In 1999, the

methodology used by our independent actuary was refined and

enhanced to provide a more reliable estimate of the self-

insured portion of our current and prior years’ ultimate loss

projections related to workers’ compensation, general liability

and automobile liability insurance programs (collectively

“casualty loss(es)”). Our prior practice was to apply a fixed

factor to increase our independent actuary’s ultimate loss

projections which was at the 51% confidence level for each

year to approximate our targeted 75% confidence level.

Confidence level means the likelihood that our actual casualty

losses will be equal to or below those estimates. Based on our

independent actuary’s opinion, our prior practice produced a

very conservative confidence factor at a level higher than our

target of 75%. Our actuary now provides an actuarial estimate

at our targeted 75% confidence level in the aggregate for all self-

insured years. The change in methodology resulted in a one-time

increase in our 1999 operating profit of over $8 million.

At the end of 1998, we changed our method of determining

the pension discount rate to better reflect the assumed invest-

ment strategies we would most likely use to invest any

short-term cash surpluses. Accounting for pensions requires

us to develop an assumed interest rate on securities with

which the pension liabilities could be effectively settled. In esti-

mating this discount rate, we look at rates of return on

high-quality corporate fixed income securities currently avail-

able and expected to be available during the period to maturity

of the pension benefits. As it is impractical to find an invest-

ment portfolio which exactly matches the estimated payment

stream of the pension benefits, we often have projected short-

term cash surpluses. Previously, we assumed that all

short-term cash surpluses would be invested in U.S. govern-

ment securities. Our new methodology assumes that our

investment strategies would be equally divided between

U.S. government securities and high-quality corporate fixed

income securities. The pension discount methodology change

resulted in a one-time increase in our 1999 operating profit of

approximately $6 million.

Human Resource and Accounting Standardization

Programs. In the first quarter of 1999, we began the stan-

dardization of our U.S. personnel practices. At the end of 1999,

our vacation policies were conformed to a calendar-year based,

earn-as-you-go, use-or-lose policy. The change provided a one-

time favorable increase in our 1999 operating profit of

approximately $7 million. Other accounting policy standardiza-

tion among our three U.S. Core Businesses provided a one-time

favorable increase in our 1999 operating profit of approximately

$1 million.

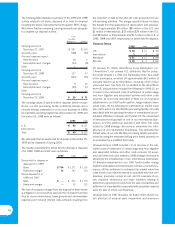

The impact of the above described accounting changes is

summarized below:

1999

Impact

GAAP $7

Methodology 14

Standardization 8

Total $29

These changes impacted our results as follows:

Restaurant margin $11

General and administrative

expenses 18

Operating Profit $29

U.S. $15

International —

Unallocated 14

Total $29

After-tax $18

Per diluted share $ 0.11

1997 Fourth Quarter Charge. In the fourth quarter of

1997, we recorded a $530 million unusual charge ($425 mil-

lion after-tax). The charge included estimates for (1) costs of

closing stores, primarily at Pizza Hut and internationally;