Pizza Hut 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

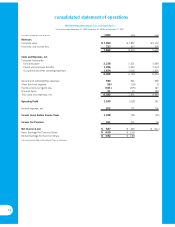

consolidated statement of shareholders’ (deficit) equity

and comprehensive income

TRICON Global Restaurants, Inc. and Subsidiaries

Fiscal years ended December 25, 1999, December 26, 1998 and December 27, 1997

(in millions) Accumulated

Investments by Other

Issued Common Stock Accumulated and Advances Comprehensive

Shares Amount Deficit from PepsiCo Income Total

Balance at December 28, 1996 $ 4,268 $ (29) $ 4,239

Net income prior to Spin-off 283 283

Net loss after Spin-off (394) (394)

Foreign currency translation adjustment (101) (101)

Minimum pension liability adjustment

(includes tax of $2 million) 22

Comprehensive Income (Loss) (210)

Net investments by and advances from PepsiCo (1,152) (1,152)

Spin-off dividend and partial repayment of advances (2,369) (2,131) (4,500)

Issuance of shares of common stock, no par value,

in connection with the Spin-off 152 —

Contribution to capital of remaining unpaid advances 1,268 (1,268) —

Stock option exercises 3 3

Balance at December 27, 1997 152 $ 1,271 $ (2,763) $ — $ (128) $ (1,620)

Net income 445 445

Foreign currency translation adjustment (20) (20)

Minimum pension liability adjustment

(includes tax of $1 million) (2) (2)

Comprehensive Income 423

Adjustment to opening equity related to

net advances from PepsiCo 12 12

Stock option exercises

(includes tax benefits of $3 million) 1 22 22

Balance at December 26, 1998 153 $ 1,305 $ (2,318) $ — $ (150) $ (1,163)

Net income 627 627

Foreign currency translation adjustment 15 15

Minimum pension liability adjustment

(includes tax of $1 million) 22

Comprehensive Income 644

Adjustment to opening equity related to

net advances from PepsiCo 77

Repurchase of shares of common stock (3) (134) (134)

Stock option exercises

(includes tax benefits of $14 million) 139 39

Compensation-related events 47 47

Balance at December 25, 1999 151 $1,264 $ (1,691) $ — $(133) $ (560)

See accompanying Notes to Consolidated Financial Statements.