Pizza Hut 1999 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

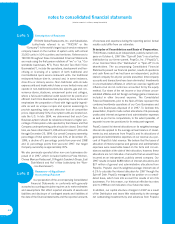

The following table displays a summary of the 1999 and 1998

activity related to all stores disposed of or held for disposal

including the stores covered by the fourth quarter 1997 charge.

We believe that the remaining carrying amounts are adequate

to complete our disposal actions.

Asset

Valuation

Allowances Liabilities

Carrying amount at

December 27, 1997 $ 291 $ 115

Amounts used (148) (36)

(Income) expense impact:

New decisions 16 5

Estimate/decision changes (33) (8)

Other 1 1

Carrying amount at

December 26, 1998 127 77

Amounts used (100) (36)

(Income) expense impact:

New decisions 9 15

Estimate/decision changes (20) 15

Other 4 —

Carrying amount at

December 25, 1999 $20 $71

The carrying values of assets held for disposal (which include

stores, our idle processing facility in Wichita, Kansas and a

minority interest investment in a non-core business in 1998)

by reportable operating segment as of December 25, 1999 and

December 26, 1998 were as follows:

1999 1998

U.S. $ 40 $ 111

International —46

Total $40 $ 157

We anticipate that all assets held for disposal at December 25,

1999 will be disposed of during 2000.

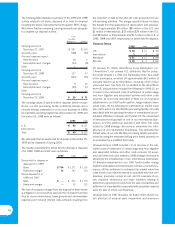

The results of operations for stores held for disposal or disposed

of in 1999, 1998 and 1997 were as follows:

1999 1998 1997

Stores held for disposal or

disposed of in 1999:

Sales $ 734 $ 1,271 $ 1,155

Restaurant margin 76 147 114

Stores disposed of in

1998 and 1997:

Sales $— $ 637 $ 1,779

Restaurant margin —55 132

The loss of restaurant margin from the disposal of these stores

is mitigated in income before taxes by the increased franchise

fees for stores refranchised, lower general and administrative

expenses and reduced interest costs primarily resulting from

the reduction of debt by the after-tax cash proceeds from our

refranchising activities. The margin reported above includes

the benefit from the suspension of depreciation and amortiza-

tion of approximately $9 million ($8 million in the U.S. and

$1 million in International), $32 million ($24 million in the U.S.

and $8 million in International) and $17 million in the U.S. in

1999, 1998 and 1997, respectively, on assets held for disposal.

Unusual Items

1999 1998 1997

U.S. $48 $11 $ 85

International 3499

Worldwide $51 $ 15 $ 184

After-tax $29 $ 3 $ 165

On January 31, 2000, AmeriServe Food Distribution, Inc.

(“AmeriServe”), our primary U.S. distributor, filed for protec-

tion under Chapter 11 of the U.S. Bankruptcy Code. As a result

of the bankruptcy, we wrote off approximately $41 million of

amounts owed to us by AmeriServe, including a $15 million

unsecured loan. See Note 22. In addition to the AmeriServe

write-off, unusual items included the following in 1999: (1) an

increase in the estimated costs of settlement of certain wage

and hour litigation and associated defense and other costs

incurred, as more fully described in Note 21; (2) favorable

adjustments to our 1997 fourth quarter charge related to lower

actual costs; (3) the writedown to estimated fair market value

less cost to sell of our idle Wichita processing facility; (4) costs

associated with the pending formation of international uncon-

solidated affiliates in Canada and Poland; (5) the impairment

of enterprise-level goodwill in one of our international busi-

nesses; and (6) additional severance and other exit costs

related to 1998 strategic decisions to streamline the infra-

structure of our international businesses. The estimated fair

market value of our idle Wichita processing facility was deter-

mined by using the estimated selling price based primarily on

an evaluation by a qualified third party.

Unusual items in 1998 included: (1) an increase in the esti-

mated costs of settlement of certain wage and hour litigation

and associated defense and other costs incurred; (2) sever-

ance and other exit costs related to 1998 strategic decisions to

streamline the infrastructure of our international businesses;

(3) favorable adjustments to our 1997 fourth quarter charge

related to anticipated actions that were not taken, primarily sev-

erance; (4) the writedown to estimated fair market value less

costs to sell of our minority interest in a privately held non-core

business, previously carried at cost; and (5) reversals of cer-

tain valuation allowances and lease liabilities relating to

better-than-expected proceeds from the sale of properties and

settlement of lease liabilities associated with properties retained

upon the sale of a Non-core Business.

Unusual items in 1997 included: (1) $120 million ($125 mil-

lion after-tax) of unusual asset impairment and severance